…For some classes of investors, notably companies and institutions with a lot of cash at hand, there is a silver lining

TUE, OCT 17 2023-theGBJournal| 2023 is proving a frustrating year for the saver who simply holds a T-bill or a Naira deposit.

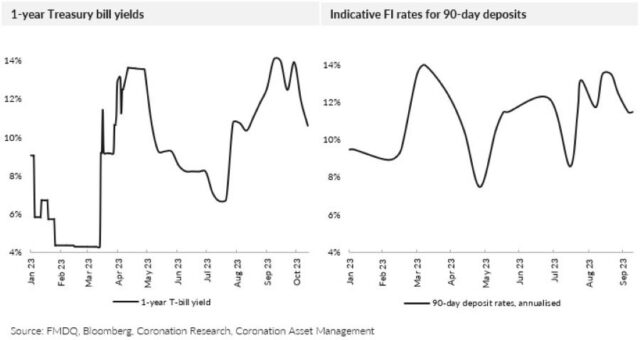

It goes without saying that most banks offer unexciting deposit rates. And 1-year T-bill rates crashed during February and March to below 4.00% per annum and, although they swiftly recovered, they dipped to around 6.00% per annum again in July.

February’s crash was due to the short-lived policy to change most of Nigeria’s bank notes for new ones.

People were forced to deposit their soon-to-be-worthless notes, swelling the coffers of banks that went on to buy T-bills, forcing the yields down. The abandonment of the policy saw banks lose liquidity again in the form of banknotes and T-bill yields moved back up.

For some classes of investors, notably companies and institutions with a lot of cash at hand, there is a silver lining. This is the deposit market available to large depositors (such as financial institutions – FI) and arranged by asset management companies.

Asset management companies typically gather a number of large deposits from different customers and place them with banks. And these banks give those asset management companies preferential rates for placing large amounts of money with them in one go. These can be double the rates paid to most of their deposit accounts.

The reason? Taking large chunks of deposits helps banks’ own liquidity as they contend with the Cash Reserve Requirement (CRR) imposed by the CBN.

The CRR is the percentage of customer deposits, set at 32.5%, that commercial banks must deposit with the CBN.

Although there has been a loosening of CRR restriction for some banks over the past few months, it seems to us that the policy remains substantially in place today.

A 90-day deposit available through this route last week yielded close to 10.00% annualised. A 90-day T-bill at that time yielded 3.19% annualised.

So, the managing of Naira deposits and T-bills this year has been less about predicting the trajectory of interest rates (who could have predicted the enormous swings created by the new bank note policy?) and more about familiarity with the available instruments.

As we argued in Coronation Research, How to Manage Short-term Naira, 02 May it makes sense to set a minimum target of a double-digit yield; see how close one can get; and not to accept low yields if at all possible.

These simple rules-of-thumb would have worked well this year.

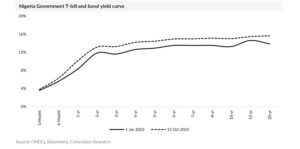

How about the future? As the yield curve chart below shows, there has been little overall direction in FGN bond rates this year. And we have yet to learn of the new CBN management’s plans for market interest rates. So, in the absence of guidance on interest rates investors may continue to keep their funds liquid and obtain the best short-term rate, whether T-bill or deposit, on offer.-with Coronation Research.

Twitter(X)-@theGBJournal|Facebook-the Government and Business Journal|email:gbj@govbusinessjournal.com| govandbusinessj@gmail.com