TUE. 24 JANUARY, 2023-theGBJournal| Risk is back. Buying risky assets, such as equities and emerging market bonds, is in fashion after long time – most of 2022 – when it certainly wasn’t.

As set out in Coronation Research: Investment Outlook, Better Times in 2023, recently, global markets are likely to anticipate the decline in inflation and start trending upwards again this year. Instances of good news are set to accumulate and translate into a well-founded upturn in global equity and bond markets.

Is this happening already? The process may have started in several developed markets. Over the past six months one major US equity index, the S&P 500, and one European index, the STOXX Europe 600, found support levels as early as October.

The Nasdaq index of technology stocks hit a support level at the end of December (close to levels also seen in October and November). Year-to-date the S&P 500 is up 4.5%,the STOXX Europe 600 up 6.9% and the Nasdaq is up 8.5%.

China is a big part of this story. A narrative developed during 2022 that China was retreating into a kind of isolation with its zero Covid-19 policies and lockdowns. That narrative swiftly changed when China opened up again and a raft of liberalising measures were introduced. The Shanghai Shenzhen CSI300 index is up 19.2% since the end of October and up 8.0% year-to-date.

Markets operate, during a turnaround, by selectively interpreting bad news as good news. The US technology sector is believed to have shed 200,000 jobs over the past 12 months, 50,000 of these from four companies alone: Alphabet (the parent company of Google), Amazon, Meta (parent of Facebook) and Microsoft. Recent announcements of layoffs have been seen as realignment of strategy with reality and have been greeted with stock rallies.

There is also straightforwardly good news, notably the decline in year-on-year US inflation from 7.1% in November to 6.5% in December. (Note that Nigeria’s headline rate of year-on-year inflation also fell, from 21.47% in November to 21.34% in December.)

Nobody expects the Federal Reserve in the US to relent in its anti-inflationary measures anytime soon, but the belief that it has inflation under control (or soon will do) is critical to generating market confidence. To that end the markets seem happy with the idea that the Federal Reserve is likely to keep its policy rates high for much of 2023.

The markets and the economy

What about the underlying economies of the world? The strange thing about global forecasts is that they continue to forecast growth in 2023 (which does not rule out the possibility of some localised and temporary slowdowns).

The latest IMF World Economic Outlook paper forecasts global economic growth of 2.7% in 2023, down from its previous forecast of 2.9%, but that its still growth.

Some corroboration can be seen in commodity markets, where copper prices have been rallying since the end of October and are up 11.2% year-to-date. The price of oil has not been doing so well, but then oil prices are strongly influenced by a cartel, the Organization of the Petroleum Exporting Countries (OPEC) and its ally Russia (OPEC+) and their combined power seems to have waned recently.

And weak oil prices are helpful to keeping inflation down in developed and emerging markets. In any event, oil prices have been trending upwards recently in response to forecasts of strong demand in 2023.

The return of risk is good for Nigeria

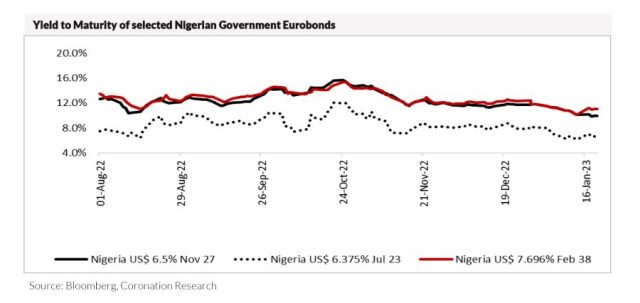

Some Nigerian assets benefit directly from the rise in global risk appetite. Yields of Federal Government of Nigeria (FGN) US dollar Eurobonds have been falling since the third week of October.

The change has been significant, with the yield of the FGN’s 6.5% coupon US dollar Eurobond, due in November 2027, falling by 577 basis points (bps) from 15.68% to 9.92% at the end of last week, a mark-to-market gain of 26.81% over three months.

Does this mean that foreign investors are buying Naira-denominated assets, such as Naira-denominated FGN bonds and NGX Exchange-listed equities? The answer is most likely no, unfortunately, as foreign exchange issues and problem with repatriation of funds persist. Foreign participation in Naira fixed income and equity markets is at low levels and likely to stay so until foreign exchange issues are resolved.

The fall in FGN Eurobond yields raises the intriguing possibility of Nigeria returning to borrow US dollars in the Eurobond markets later this year, if yields continue to fall and reach the point at which the government believes it makes economic sense to issue bonds.

Nigeria did not share the fate of Ghana last year, which needed restructure its high-yielding domestic and international debt, and so Nigeria remains a credible Eurobond debtor.

The return to risk could, at some point this year, directly benefit Nigeria’s finances.-Analysis is with Coronation Research

Twitter-@theGBJournal|Facebook-The Government and Business Journal|email:gbj@govbusinessjournal.ng|govandbusinessj@gmail.com