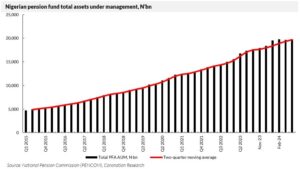

TUE JUNE 04 2024-theGBJournal|There are few positive long-term trends in Nigerian financial markets that one can rely on, but the rise in pension funds comes close.

The total assets under management (AUM) of Nigerian pension funds has increased at a compound average growth rate of 16.3% over the past five years.

There may be occasional month-on-month falls in total AUM, but there has been no annual fall over the period we measure (from 2015 to the present).

Last year the industry crossed the benchmark of 10 million retirement savings accounts. Additions to the industry’s AUM are a function of the numbers of contributors, their salaries, investment performance and withdrawals.

The structure is all-but-guaranteed to deliver growth, but not always ahead of the rate of inflation. Last year’s total AUM gain was 22.43%: inflation ended the year at 28.92% y/y.

At the same time, few industries deliver such consistent growth. Consistency is rare, so pension fund management companies are highly sought after and consolidation is afoot.

What of Nigerian pension funds’ holdings in the equity market? These rose by 16.0% between the beginning of this year and the end of April, which was a lower rate of appreciation than that of the NGX All-Share index over the same period (+31.4%).

This suggests, among other things, that pension funds have been scaling back their equity exposure recently.

The makes sense in the context of risk-free investment rates (T-bill and FGN bonds) which have rocketed this year, and in view of upcoming bank recapitalisation for which, doubtless, they will be asked to subscribe for new shares.-Analysis is written by Coronation Research and made available to theG&BJournal

X-@theGBJournal|Facebook-the Government and Business Journal|email:gbj@govbusinessjournal.com|govandbusinessj@gmail.com