TUES, 28 JUNE, 2022-theGBJournal| On 23 June MSCI Inc., a global provider of equity, fixed income and real estate indexes, announced that it is considering removing Nigeria from its Frontier Markets Indexes (MSCI Frontier Markets and MSCI Frontier Markets 100 indexes), citing currency restrictions.

Specifically, since March 2020, FX illiquidity and the widening chasm between the official and parallel Naira exchange rates, according to MSCI Inc., have led to FX conversion and fund repatriation problems for foreign investors in the Nigerian equities market. As a result, according to MSCI Inc.: “Market participants have continuously expressed concerns related to the investibility and replicability of the MSCI Nigeria Indexes and related composite indexes, such as the MSCI Frontier Markets Index.”

This is not the first time MSCI Inc has considered removing Nigeria from the MSCI Frontier Markets (FM) Index. In April 2016, a similar situation occurred owing to the Central Bank of Nigeria’s currency restrictions at the time. The market’s view then was that around US$500m in funds benchmarked to the MSCI FM index would head for the exit. In the end, Nigeria was not ejected, FX liquidity improved a year later (2017), and foreign investors bought Nigerian equities again in significant volumes.

The situation now, six years later, is very different in terms of potential impact, in our view. Overall, we expect the impact to be very limited, for two reasons.

First, since the beginning of 2018, around N439.43bn (US$1.04bn at today’s rate) of foreign investor money has left the NGX Exchange. Foreign investors only account for around 13% of trading on the exchange compared with a long-term average of around 42%. The foreign funds remaining are either unable to withdraw or remain committed to the Nigerian investment case for the long term.

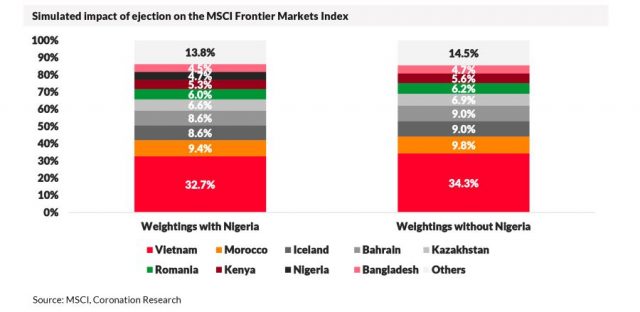

Second, although it is difficult to estimate the total amount of money benchmarked to MSCI FM indices, we know it is substantially lower than it was in 2016. Many funds have abandoned the benchmark or switched to broader benchmark indices, e.g. the MSCI Frontier Emerging Markets Index. As of April 2022, Nigerian stocks made up only 4.7% of the MSCI Frontier Markets (FM) Index, a far cry from March 2016, where Nigerian stocks made up 11.7% of the MSCI FM Index.

We have studied the factsheets of the remaining FM Exchange Traded Funds (ETF) and some of the largest dedicated FM equity funds and found that if they were to sell their entire remaining holdings in Nigeria, this would account for just $150.0m (N63.1bn) of foreign equity selling.

Interesting, however, is that a lot of the exposure in the funds we looked at are in Airtel Africa, which Is dual-listed and which could imply funds are only invested in the telco stock as a means of using the dual listing for repatriation of funds. Nevertheless, assuming all those funds were liquidated, it would equate to about 13 days of average daily traded value. Even then, the ability to repatriate those funds would not be guaranteed and the process could be protracted, in our view-With Coronation Research

Twitter-@theGBJournal| Facebook-The Government and Business Journal|email: gbj@govbusinessjournal.ng|govandbusinessj@gmail.com