…Given the enormous aggregate size of pension funds, at N17.1 trillion, we imagine that pension funds are active in the most liquid stocks.

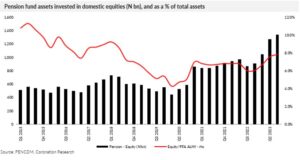

…Pension funds’ enthusiasm for equities in 2023 contrasts with their behaviour in 2022. In 2022 the total assets of pension funds rose by 11.7% but their equity holdings actually fell by 0.8% over the year.

TUE, OCT 24 2023-theGBJournal|It has taken a long time, and almost four successive years of positive equity returns from the NGX Exchange, but it appears that Nigeria’s enormous pension funds are warming to equities again.

In contrast with industry data from 2022, the evidence this year suggests that pensions funds are enthusiastic buyers of equities.

From the beginning of 2023 to the end of July, the total AUM of Nigeria’s pension funds rose by 13.8% to N17.1 trillion (US$21.1bn at the NAFEM rate last Friday). The value of their equity holdings rose by 47.5% to N1.3 trillion over the same period.

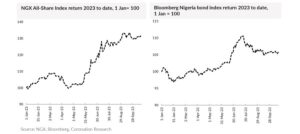

The 25.5% rise in the NGX All-Share Index over that period does not account for that increase. So, either Nigerian pension funds are very good stock pickers, or they were net purchasers of equities. The big rise in their equity position was likely a combination of net purchases – up to N200.0bn, we think – and reasonable stock selection.

This took the percentage of equities in the assets under management of pension funds from 6.1% to 7.8%. If we look at the four months from the end of March to the end of July, the total equity holdings of pension funds rose from N1.04 trillion to N1.34 trillion, a rise of 28.4% compared with a rise in the total AUM of pension funds of 9.5%.

The NGX AllShare Index only rose by 17.3% over the same period so, again, pension funds were in all probability net buyers of equities.

Which equities have they been buying? It is difficult to pinpoint the answer with any accuracy. The National Pension Commission (PENCOM) gives data on equity holdings but does not break down the data (which is hardly surprisingly given the complexity that would involve). We need to use some assumptions.

Given the enormous aggregate size of pension funds, at N17.1 trillion, we imagine that pension funds are active in the most liquid stocks. And, for the most part, this means bank stocks.

Though not the largest stocks by index weight, banks are the most liquid, tending to have high free floats relative to their total equity. And banks tend to be generous dividend payers, something pension funds likely warm to.

Pension funds’ enthusiasm for equities in 2023 contrasts with their behaviour in 2022. In 2022 the total assets of pension funds rose by 11.7% but their equity holdings actually fell by 0.8% over the year.

Given that the NGX All-Share Index rose by 19.98% last year this either means that pension funds were net sellers of equities or poor stock pickers (NB the subindex of banks only rose by 2.81% last year), or a combination of the two.

At any rate, the data from PENCOM points to a change in attitude towards equities, in our view. Pension funds may well have observed that the return from the NGX All-Share Index was 50.03% in 2020, 6.07% in 2021 and 19.98% in 2022, cumulatively beating inflation by a decent margin and bond returns by a large margin.

The comparison between bond and equity returns so far this year suggests that 2023 will be no different.-Analysis is provided by Coronation Research

Twitter(X)-@theGBJournal|Facebook-the Government and Business Journal|email:gbj@govbusinessjournal.com| govandbusinessj@gmail.com