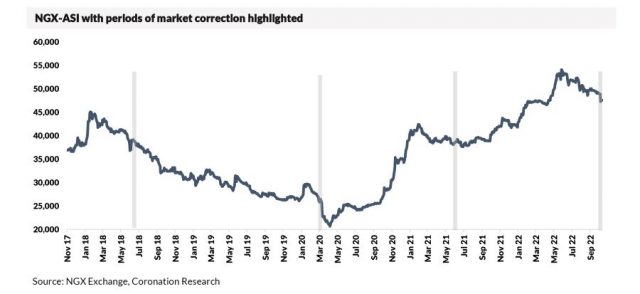

WED, 12 OCT, 2022-theGBJournal| Nigerian stocks, as measured by the benchmark NGX All-Share Index (ASI), officially fell into correction territory last week. This represents a decline that exceeds 10% from its most recent peak or high. On the other hand, a bear market is typically defined as a 20% drop from recent highs.

Stock market downturns such as these occur periodically and for various reasons. Sometimes the changes are related to excessive market valuations after an extended bull market. In other cases, they may be due to external events which overwhelm other fundamental factors that traditionally drive stock market performance.

The most recent downturn can be attributed to increasingly hawkish monetary policy by global central banks and by the CBNbwhich both cause market interest rates to rise.

The previous market declines over the last five years

Explanations for most serious market downturns are typically easier to come by after the fact. Consider some recent examples.

In early 2018, an extended bear market began that persisted until June 2020. This downturn came on the heels of the bull market caused by the sharp devaluation in the Naira, the introduction of the I&E window, and improved liquidity in the FX market. The most notable driver of the setback was the US Federal Reserve’s hawkish monetary policy which led to a flight to safety and significant outflows from emerging market equities and debt.

In February 2020, investors were beginning to come to grips with the reality of the COVID-19 pandemic. Concerns about the unknown ramifications to the economy from social distancing and travel restrictions caused investors to lose confidence in stocks. However, that downturn was short-lived, and those who remained invested in stocks prospered through much of 2020.

A rise in domestic interest rates largely drove the May 2021 correction. However, the equities market began to rise again in July 2021 once it was clear that the increase in interest rates was temporary (rates began to fall again).

Stocks remain susceptible

Challenges such as CBN monetary tightening and rising inflation have kept the stock market volatile for most of the second half of 2022. As we advance, market fundamentals, such as corporate revenue and profits, will likely be an additional concern. A major question now is whether rising inflation is hurting the bottom line for companies. Companies have been able to maintain earnings levels because they have pushed through price increases, but with consumer wallets already under extreme pressure, can they continue to do that? It will tell us a lot about how earnings hold up over the next twelve months.

Maintaining the right perspective

It is important to maintain a proper perspective on the environment. We are likely to experience market ups and downs regardless, and overtime, markets have shown an ability to recover.

Markets are likely to continue to be volatile given the uncertainty about the extent of the CBN’s interest rate hikes, the pace of earnings growth and the implications of the upcoming elections early next year, among other factors. While we may see a more favourable environment develop down the road, the market still faces many challenges, given its current economic underpinnings. Nevertheless, we urge investors to maintain a long-term perspective as timing the markets and being precise on when to enter and exit is challenging.

Our investment approach is not to make binary calls, up or down, on the direction of equity markets. Instead, we buy value when we see it. When there is a clear downward direction in markets, like now, we avoid trouble as much as possible. A combination of value investing and prudent portfolio management is the means to maximise investment returns.-With Coronation Research

Twitter-@theGBJournal| Facebook-The Government and Business Journal|email: gbj@govbusinessjournal.ng|govandbusinessj@gmail.com