WED. 08 MARCH 2023-theGBJournal | Last week, Bola Ahmed Tinubu of the All Progressives Congress (APC) was announced as the winner of 2023’s presidential election, with Kashim Shettima as his Vice-President.

President Tinubu now presides over the levers of power in the Federal Government and his policies will have a strong influence on the investment climate. So, we need to look at the APC’s election manifesto as the best guide to the investment implications of his victory.

The APC is pro-growth, and its manifesto looks to government spending as the means to achieve it. In contrast with the recent GDP growth trend of around 3.0% per annum, the APC wants to achieve an average of 10.0% GDP growth throughout its term in office.

Assuming that the Federal Government is set to vastly increase expenditure then the obvious beneficiary, in broad terms, would be infrastructure. Note that the APC manifesto also has ambitious targets for developing housing which is also to be funded from the public purse, although we would expect banks to get involved in this process. When we think of infrastructure we immediately think of cement, so this points to increased demand for the products – among listed companies – of Dangote Cement, BUA Cement and Lafarge Africa.

The general theme in the cement sector is one driven by capacity expansion, utilisation and rising prices. These factors have boded well for the companies which have reported double digit-revenue growth for FY 22. Beyond double-digit topline growth, cement producers remain faced with margin pressure from surges in energy costs (especially diesel) in production and operating expenses and finance cost increases driven by foreign exchange losses.

Nonetheless, we are optimistic that the sector is poised for growth in 2023 as it maximizes price and volume increases while efficiently managing costs.

Dangote Cement remains our top pick and accordingly we maintain our BUY recommendation on the stock with a target price of N328.65. At a current price of N278, the potential upside is 18.2%.

For BUA Cement, we maintain our SELL recommendation with a target price of N44.60. At a current price of N99.75, the potential downside is -55.3%. For Lafarge Africa, we maintain our BUY recommendation on the stock with a target price of N39.23. At a current price of N27.00, the potential upside is 45.3%.

Another place to look for potential upside is the consumer sector, which includes food manufacturers, manufacturers of branded household goods and extends to the brewers. However, government expenditure currently accounts for roughly 8.0% of GDP and we question the extent to which government can directly influence these sectors.

Even if government expenditure expands significantly, which is what the APC manifesto recommends, it is still unlikely to affect a high proportion of Nigeria’s circa 200 million citizens. So, we think the effects of future government expenditure on the average consumer will be limited.

Another point is the consumer wallet. Recent data for headline inflation places it at over 20.0% and it seems to be sticky, in other words it is unlikely to decline soon. Therefore, we think that consumer wallets will continue to be under pressure.

Conditions of high infrastructure spending are good for banks. We think that the Federal Government will want to involve banks in its expansion plans, in order to generate financial leverage. So, it is possible to foresee how banks will be encouraged to lend to infrastructure projects, housing projects as the APC manifesto encourages provisions for affordable consumer loans for automobiles and expensive domestic appliances and imposes penalties on non-compliant banks. This is likely to provide a boost to banks’ efforts to expand loan books and Net Interest Income.

When it comes to banks, remember that they are already closely regulated, with the Loan-to-Deposit ratio (LDR, introduced in 2019) requiring banks to make customer loans equivalent to 65.0% of customer deposits, a cash reserve requirement (CRR) of 32.5% (which is generally acknowledged to be in excess of 50.0%) and several other measures. The banks may reasonably argue that their hands are tied and may push for a degree ofre-regulation to free up liquidity and capacity. Given that they are well-capitalised and that current non-performing loan (NPL) levels are low, they are in a good position to benefit from growth opportunities and, possibly, a degree of regulatory forbearance.

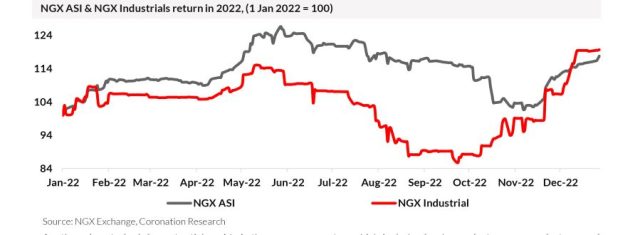

The banks may provide interesting investment opportunities today as they have been held back by regulatory constraints in recent years, in our view. The banking sector was an underperformer during 2022, with the NGX Banking sub-index returning 2.41% versus 19.98% for the NGX All-Share Index. And several bank stocks have dividend yields in excess of 10.0%. Full-year 2022 dividends are due over the coming months.

Fixed Income

Our base view for fixed income in 2023 is that yields are under downward pressure while there is high liquidity during the early part of the year, but that Federal Government of Nigeria (FGN) borrowing is likely to impact the market later on in the year with the effect of pushing market interest rates back up. How does the presidential election success of the APC change this?

A lot depends on how much-expanded government expenditure is funded. It is too early to say, at this stage, but one possibility is that a portion of government expenditure will not be funded through the T-bill and bond markets and instead come from ‘Ways and Means’ loans from the Central Bank of Nigeria (CBN). This could lead to plentiful liquidity in financial markets, with the effect that T-bill and FGN bond rates decline,reducing risk-free returns and prompting investors to take risks, such as buying equities. It is likely too soon to make a firm judgment on this point, but it is important to mention this possible outcome.

Conclusions

Our approach is to follow the APC’s pro-growth message and see how it is likely to play out in the equity and fixed income markets. Important caveats are that we do not know how quickly President Tinubu will appoint a government nor do we know whether the APC manifesto will be implemented to the letter: on balance we believe that this administration is likely to form itself quickly and execute its agenda professionally and swiftly. Therefore, investors may be advised to look out for the opportunities in listed infrastructure and banking stocks. In the fixed income markets, we will seek confirmation of how this government will fund its plans and adjust our view accordingly.-Analysis is provided by Coronation Research

Twitter-@theGBJournal|Facebook-the Government and Business Journal|email:gbj@govbusinessjournal.ng|govandbusinessj@gmail.com