TUE, 16 AUG, 2022-theGBJournal| Markets are looking more familiar these days. In Coronation Research recent report-FGN bond yields on the move (18 July 2022), how Federal Government of Nigeria (FGN) bonds denominated in US dollars were yielding more than equivalent ones in Naira was discussed. As expected, this was a short-term occurrence, and the relationship has been restored to normal.

A month ago Nigerian Eurobonds were under considerable selling pressure driven by the aggressive monetary policy tightening by major central banks and the deterioration in risk appetite amid mounting global geopolitical tensions.

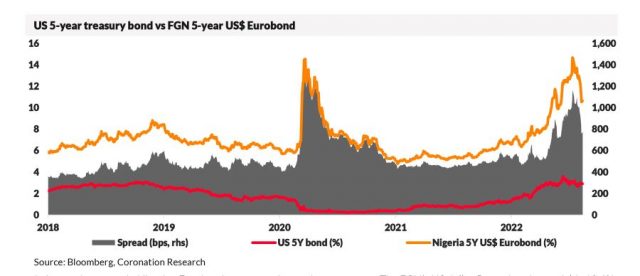

In addition, concerns over Nigeria’s fiscal outlook intensified. Consequently, the spread between the 5-year Nigerian Eurobond and the comparable US Treasury yield sat above 1,000bps, a level associated with countries in fiscal distress.

In just under a month, Nigerian Eurobonds appear to be staging a recovery. The FGN’s US dollar 5-year bond now yields 10.6% (a 404bps compression), the entire yield curve has shifted downwards, while Nigeria’s premium has dropped to 760bps.

The recovery in Nigerian Eurobonds comes from the broader bull-flattening bias across core bond markets as traders readjust their interest rate and growth outlooks for the developed world. In addition, fears of a global recession are intensifying as investors fret that the aggressive policy tightening to rein in inflation will stifle economic activity.

At the same time, the yield on the FGN’s Naira-denominated 5-year bond has jumped 202bps to 12.7% in the secondary market.

A similar movement has occurred across the Naira bond curve due to tight system liquidity and the consequent rise in yields at the July 2022 bond auction. In addition, tighter monetary policy signalling by the CBN and expectations of increased borrowing to fund the FGN budget deficit have contributed to upward movement in long-term rates. As a result, FGN Naira rates now exceed FGN US dollar rates.

Weak macroeconomic data from across the globe continues to underpin the notion that the global economic outlook is becoming gloomier. However, the dovish shift in implied interest rate expectations is bullish for bonds. It also suggests that if the FGN chooses to borrow in US dollars in public debt markets, debt servicing costs could be lower-than-expected over the medium term. This will be a relief to the FGN, which has been hit hard by the sharp rise in international borrowing costs.-With Coronation Research

Twitter-@theGBJournal| Facebook-The Government and Business Journal|email: gbj@govbusinessjournal.ng|govandbusinessj@gmail.com