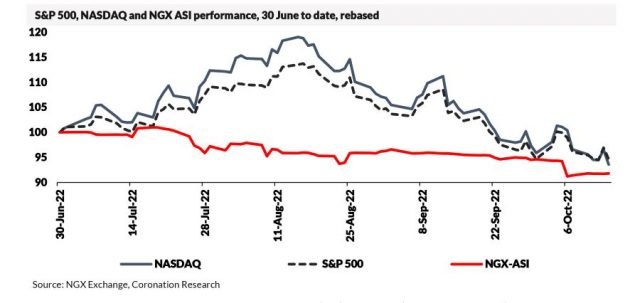

TUE, 18 OCT, 2022-theGBJournal| After several months with zero correlation, Nigerian equity and bond markets have begun to trend downward with global markets, especially US markets. Recall that in their report, Coronation Research, Global Markets and Nigeria II (22 August), they showed how Nigerian and US markets had shown no signs of correlation since the beginning of the year – indeed, they seldom correlate

In the first half of the year, Nigerian markets rallied on the back of low short-term market yields in Naira and the rally in oil prices while US markets tumbled.

By the beginning of the third quarter strong Q2 2022 earnings supported US equity markets, while Q2 earnings failed to lift the equity market in Nigeria. Now both markets are moving in a similar direction.

The reason for this is none other than expectations of further global monetary policy tightening, primarily in the US. Unabating inflation and strong economic data continue to undermine the efforts of the Federal Reserve to slow down the economy.

The change in focus away from earnings and towards the Federal Reserve’s problems has eroded all the gains from Q2 22 earnings season. The S&P 500 (-16.77%) has made a correction, while the NASDAQ composite (-21.38%) has entered a bear market from their mid-August highs. Year to date the NASDAQ is down 34.03% while the S&P 500 has shed 24.82%.

In September, the US economy added 263,000 jobs, well above market forecasts of 250,000, which points to a tight labour market and pressure on inflation. The US headline consumer price index (CPI) for September came in at 8.2% y/y (versus 8.1% y/y consensus) while core inflation came in at 6.6% y/y (versus 6.5% y/y consensus).

These data suggest further policy tightening by the Federal Reserve which arouses fears of an economy going into recession. Year to date, the Fed has raised its

policy rate by 300bps keeping the Fed funds rate in a band of 3.00% – 3.25% and markets expect these rates to reach 4.00% – 4.25% by year-end. Consequently, the yield on the US 10-year treasury note has risen above 3.99% for the first time since April 2011 while the yield on the US 2-year treasury note has risen to a 15-year high of 4.47%, bringing the yield curve inversion to – 48bps.

The dynamics of Nigerian markets are remarkably similar. Nigeria’s NGX-All Share Index has registered a correction, down 12.05% from its 27 May high. Bearish sentiment reflects the implication of interest rate hikes and the pass-through to Naira fixed income yields. Across the curve, secondary market yields have risen by an average of 220bps between 1 January 2022 and 14 October 2022.

As the Q3 2022 earning season begins, analysts expect aggregate annual S&P earnings growth of 2.8%, which is well below the 5-year average of 8.7%. There are expectations of some short-term support for US equity markets as at least some companies are likely to show resilience in the face of high rates and high inflation.

Nonetheless, in the light of stubborn US inflation, the likelihood of rate hikes and the possibility of a US recession, we cannot discount the possibility that US equity markets will continue to be under pressure. In fact, this seems to us to be the most likely outcome.

For Nigeria, Coronation Research view remains that continued policy tightening by the monetary authorities and elevated Federal Government domestic borrowing will continue to drive yields upward over the coming months amidst global monetary policy normalization this year.

Nonetheless, Q3 2022 results are also due to be released in the course of the month.

These may give a degree of support to the market though we remain fundamentally cautious about Nigerian equities for the rest of this year, given the upwards trajectory of market interest rates.- theG&BJournal with Coronation Research

Twitter-@theGBJournal| Facebook-The Government and Business Journal|email: gbj@govbusinessjournal.ng|govandbusinessj@gmail.com