TUE, AUGUST 01 2023-theGBJournal |What does the second half of 2023 hold for fixed income Naira savers, i.e. those who choose to hold T-bills and FGN bonds rather than equities?

Over the past few months we have seen Nigerian banks become more liquid than they were before and an increase in bank liquidity has put downward pressure on T-bill yields.

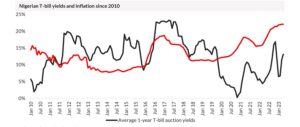

That was before last week when there was a weak T-bill auction, T-bill rates moved back up and the Monetary Policy Committee (MPC) of the CBN put its official rate up 25bps to 18.75%. T-bill yields still remain well below inflation, but its there hope for Nigerian savers?

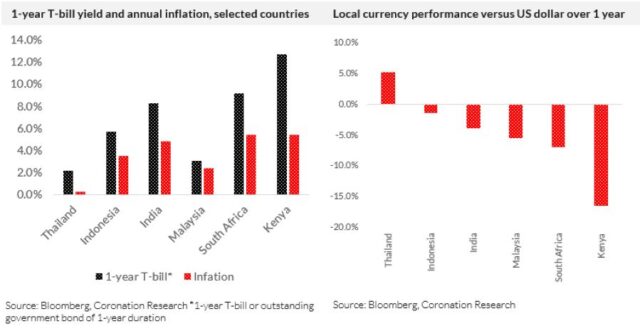

It helps to compare the lot of Nigerian investors with the experience of fixed income savers in other countries. We have a taken a selection of African and Asian countries to make a comparison.

Some of these nations are much richer than Nigeria in terms of nominal US dollar GDP per capita (e.g. South Africa and Thailand) but others are comparable (e.g. India and Kenya).

All the countries in our selection have 1-yearlocal-currency T-bill rates, or outstanding 1-year local-currency government bond yields, in excess of inflation. As a result, savers can simply invest in their governments’ fixed income securities to obtain inflation beating returns.

A feature of these countries is that, for the most part, their currencies have either depreciated moderately against the US dollar over the past year, or appreciated (in the case of Thailand).

A risk-free rate in excess of the rate of inflation encourages savers to keep their money in the local currency rather than to exchange it for US dollars.

Other countries are not so fortunate. Pakistan’s 1-year T-bill rate is 22.99% but annual inflation rate is 29.40%.

Its currency has depreciated by 21.88% against the US dollar over the past year. Ghana has a 1-year T-bill rate of 30.45% compared with an annual inflation rate of 42.50%. Its currency has depreciated by 24.51% against the US dollar over the past year.

Where does this leave Nigeria? Nigerian fixed income savers have been without a risk-free fixed-income return above the rate of inflation since the fourth quarter of 2019, which is coming up to four years.

Not surprisingly, they have taken risk assets in order to make headway away against inflation, with the NGX All-Share Index recording positive returns in 2020 (+50.03%), 2021 (+6.07%), 2022 (+19.98%) and 2023 year-to-date (+26.94%). Over the past three and a half years investors in the NGX All-Share Index would have beaten inflation, on average.

The current relationship between Nigerian risk-free returns and inflation again argues for buying risky assets such as equities. Yet, last week the CBN raised the Monetary Policy rate by 0.25% to 18.75% which suggests that it wishes to continue tackling inflation and a weak T-bill auction saw T-bill and FGN bond yields jump.

Further, the new administration of President Ahmed Bolu Tinubu has only just announced its list of ministers. The new administration, therefore, has yet to announce its over-arching policy on market interest rates. Taking risky assets may be the order of the day, but we need to keep a close eye on policy developments. This Analysis is provided by Cordros Research.

Twitter-@theGBJournal|Facebook-the Government and Business Journal|email:gbj@govbusinessjournal.com| govandbusinessj@gmail.com