…We think that a range of theoretical fair values falls between N740.2/US$1 and N852.7/US$1, compared with the current N1,482.8/US$1

TUE MAY 28 2024-theGBJournal| For the past two weeks we have presented arguments about the fair value of the Naira.

We have established that the current spot price is a far out of line with a range of fair values, which we have tracked since 2010.

We think that a range of theoretical fair values falls between N740.2/US$1 and N852.7/US$1, compared with the current N1,482.8/US$1. At the same time, we know that theoretical fair values do not set the market price: in a liberalised market the price is set by supply and demand. Now we search for evidence of those flows.

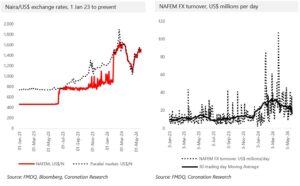

To begin with, the news is good. The bane of the currency market is to have a parallel market rate at odds with the interbank rate (currently known as the NAFEM rate), a situation that results from pent-up demand for US dollars which the official market cannot meet. So, the fact that the NAFEM rate and the parallel rate have aligned (or traded very close to each other) since the beginning of February brings confidence.

We expect that confidence to be expressed by rising volumes in the NAFEM market, and indeed this took place during the early months of the year, exactly when the NAFEM and parallel rates merged. At first this went hand-in-hand with a strengthening of the Naira, but around mid-April turnover began to fall and the exchange rate weakened again.

It is important to understand liquidity factors that may drive the market. One of these is the redemption of non-deliverable forwards (NDF). NDFs are settled in Naira for US dollar deals, with settlement in Naira at the prevailing spot rate. NDFs are entered into by financial investors and by trade investors (trade, letters of credit, collections, invisibles, etc).

see also/

It appears that there is an exceptionally large redemption, with a face value of US$1.3bn, due this week. This does not mean that the CBN is going to pay the Naira equivalent sum of US$1.3bn this week: the CBN is only due to pay the difference between the rate at which the contracts were made and the current spot rate.

Since we do not know the strike price of each contract, we do not know the sum of Naira which the CBN will pay. And, indeed, for some trade contracts, struck as lower Naira/US$ exchange rates than the current rate, the CBN may receive money.

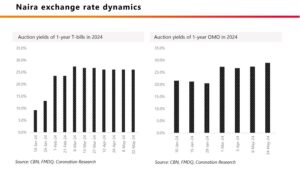

All the same, it appears that the CBN is looking to encourage foreign portfolio investors to reinvest their Naira proceeds (see our account of last week’s OMO auctions on page 1), rather than purchase US dollars in the NAFEM market.

This would suggest that there is potential for significant US dollar demand this week. Indeed, we would expect the CBN to be active in the foreign exchange market this week, supplying US dollars.-Analysis is written by Coronation Research and made available to theG&BJournal

X-@theGBJournal|Facebook-the Government and Business Journal|email:gbj@govbusinessjournal.com|govandbusinessj@gmail.com