Back in May we asked whether foreign investors were returning to Nigeria and concluded

that there would not be much increase in their activity for the rest of the year.

Yet, although foreign investment has not picked up much, the outlook appears to us far

better than it did then.

TUE OCT 29 2024-theGBJournal| On the face of it, foreign investors are none too enthusiastic about Nigeria in 2024.

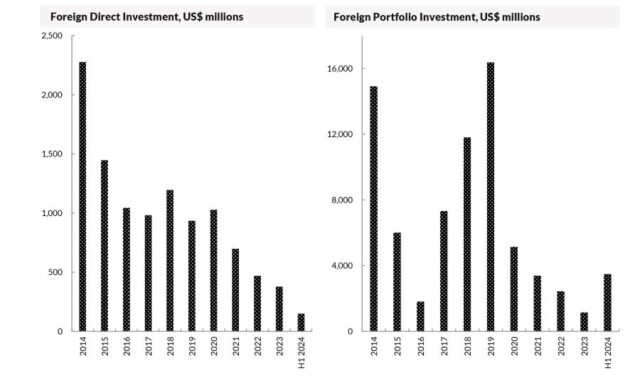

Foreign Direct Investment (FDI) has been trending down for several years. Foreign Portfolio Investment has picked up, most likely as a consequence of the CBN settling most of the backlog of foreign exchange demand earlier this year but has been trending down in recent months. Where will it go now?

Governments and economists rate Foreign Direct Investment (FDI) more highly than Foreign Portfolio Investment (FPI). FDI demonstrates commitment to invest in an economy because invested capital is serviced with dividend payments paid to the foreign owners over the long term.

By contrast, FPI tends to be invested in short term government securities and this money has to paid back soon, often within a year. FDI is the better indicator of confidence and of economic stability.

Against this, consider that nations need to take hard currency when then can. FPI builds foreign exchange reserves (in the short-term) which themselves build confidence.

The CBN’s gross foreign exchange reserves were US$32.7bn in mid-April but have risen to exceed US$39.0bn recently.

The first half of this year saw FPI inflows to Nigeria climb to US$3.48 billion, according to the National Bureau of Statistics, a much higher number than for the full years 2022 and 2023, though much lower than some prior years (notably 2014, 2018 and 2019).

This shows foreign investors willing to buy Naira-denominated government issued T-bills and bonds, as well as other securities.

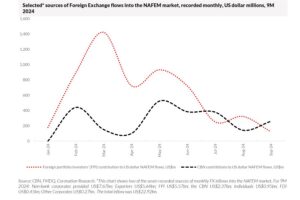

Data from the NAFEM market gives a monthly breakdown of FPI inflows this year. These show that FPI peaked in March this year and then declined towards September. Is this bad news?

We do not think so. FPI is by nature seasonal. International investors in these markets frequently build their positions early in the year, hoping to lock in profits by around this time of year (e.g. by investing in nine-month T-bills in January, or six-month T-bills in March).

If foreign investors are showing more interest in 2024 than they did in 2023, and if the macroeconomic outlook is improving, then it augurs well. We think FPI is on its way to recovery in early 2025.-Analysis is written by Coronation Research and made available to theG&BJournal

X-@theGBJournal|Facebook-the Government and Business Journal|email:gbj@govbusinessjournal.com|govandbusinessj@gmail.com