TUE, JULY 04 2023-theGBJournal |Just over a month into a new presidential administration and things are looking up for Nigeria’s banks.

First came the removal of fuel subsidies, which makes the Federal Government of Nigeria richer by some US$8.6bn per annum (based on 2022’s budget), and which in turn implies that the FGN will be less inclined than before to see banks as a source of financing via their customers’ deposits.

Second came last month’s liberalisation of the foreign exchange market. Recall that in March 2020, and in response to a range of macroeconomic challenges stemming from the onslaught of the Covid-19 pandemic which included very depressed oil prices, the CBN reduced the flow of US dollars which it had previously made available to the I&E Window and other official FX markets.

The result was a fall in the US dollar of the Naira in the parallel market. Lack of official FX liquidity hurt the banks while the official rate and the parallel rate diverged.

And it was announced recently that the CBN will introduce Naira-settled over-the-counter FX futures for tenors of 13 to 60 months, while there will also be Naira-settled Exchange-Traded Futures traded on FMDQ. The currency markets are waking up.

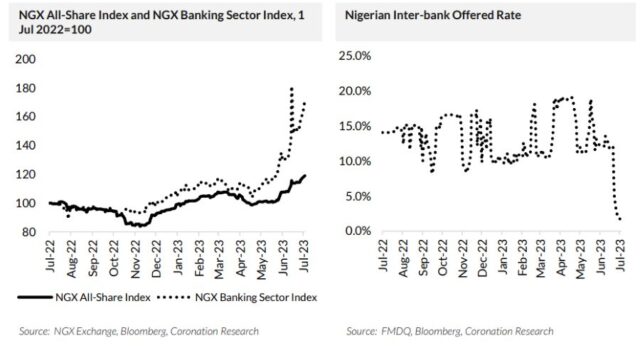

Third came a technical change to the Naira inter-bank market with potentially wide-reaching consequences. The rate at which overnight NIBOR could trade had been linked to the lower band set around the Monetary Policy Rate (MPR) at 18.5%, effectively putting an 11.5% floor to interbank rates.

This was removed last week, with a resulting crash in interbank rates, increase in bank liquidity and the enthusiastic response to Friday’s T-bill auction. In Friday’s T-bill auction, the CBN offered N187.1bn (US$243.1m) with a total subscription of N753.5bn. The average yields at auction fell by 159bps to 4.49% per annum.

Not surprisingly, investors in listed bank stocks are enjoying the change. For them it is case of plenty following a drought.

The NGX Exchange sub-index of banks rose by just 2.8% in 2022 compared with a 19.9% return for the broad NGX All-Share Index.

This year the sub-index of banks is outperforming, with a price return, year-to-date, of 65.1% compared with 20.9% for the NGX All-Share Index.

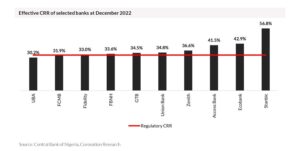

If one looks back over the accretion of bank regulations that have held banks in check over the past few years, the cash reserve requirement (CRR) would feature as the one which bank CEOs like the least.

Some 32.5% (or more, in some instances) of their customers’ Naira deposits were held by the CBN to be on-lent to the FGN.

We understand that there is talk of the CRR being reduced in some way. It is early days (we are only a month into a new administration) but the portents for banks are good.

As we argued in Coronation Research, Nigerian Banks: a Year of Resilience and Grit, 30 March, the valuations a few months ago were compelling. All that was needed was a catalyst.

Analysis is provided by Coronation Research

Twitter-@theGBJournal|Facebook-the Government and Business Journal|email:gbj@govbusinessjournal.com| govandbusinessj@gmail.com