…This January rally might prove to be similar to past ones. It may point to a positive return for the full year

…January 2024 has presented us with an extraordinary scenario. We saw the index surge by 35.8% over the month. Compare this with the total return of 45.9% for the entire year of 2023.

TUE, FEB 06 2024-theGBJournal| In our recent publication, Nigeria Weekly Update (https://www.govbusinessjournal.com/analysis-should-you-sell-the-january-rally/) Should You Sell the January Rally? 23 January, we analysed market trends over the past fifteen years and observed that January typically experiences a rally in the NGX All-Share Index (NGXASI) 60% of the time.

More notably, these January rallies often serve as reliable predictors for the market’s performance throughout the entire year, even if they tend to correct and offer opportunities to buy the market more cheaply a few months later.

January 2024 has presented us with an extraordinary scenario. We saw the index surge by 35.8% over the month. Compare this with the total return of 45.9% for the entire year of 2023.

And compare January’s 35.8% return (39.6% up until the end of last week) with the average return of a January rally (nine of them over the past 15 years) of 8.1%. Was January 2024’s 35.8% return truly representative of the market? Was it a good guide to most of the stocks in the market?

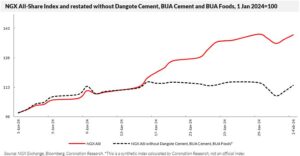

We think not. The rally in January 2024 has been predominantly driven by significant gains in just three stocks: Dangote Cement; BUA Cement; BUA Foods. To understand the impact of these stocks on the overall market performance, we have constructed a synthetic index that excludes these three outperformers.

This approach allows us to evaluate whether the market would have aligned with the typical returns seen in past January rallies, had these three stocks not performed

exceptionally well. Our findings from this adjusted index provide a clearer perspective on the true market dynamics during this unusual January rally.

Taking out the effects of these three big outperformer stocks on the index, our study shows the rest of the market would have delivered a 15.4% return in January. This, in our view, reflects the underlying performance of the market, reflecting the broad-based demand for a large number of different stocks.

It is also a more compatible return with the average January rally of 8.1% than the headline figure of 35.8%.

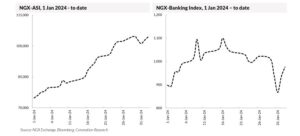

Our analysis suggests that investors were enthusiastic about the market in January, though not as enthusiastic as the headline performance suggests. Recent corrections (over the past two weeks) in the sub-index of banks suggest that at least some investors are taking profits.

This January rally might prove to be similar to past ones. It may point to a positive return for the full year, but it may also be followed by a period of profit-taking and opportunities to buy later.-Analysis is written by Coronation Research

X-@theGBJournal|Facebook-the Government and Business Journal|email:gbj@govbusinessjournal.com|govandbusinessj@gmail.com