TUE, 01 NOV, 2022-theGBJournal| At times of worldwide economic stress, global markets exert a strong influence on Nigerian markets. The rise in US interest rates this year is associated with rising Federal Government of Nigeria (FGN) Eurobond yields and the FGN’s consequent reliance on Naira-denominated financing this year, causing Naira bond yields to rise. How soon the US interest rate cycle will turn is important for all classes of investors, including US equity investors and Nigerian fixed-income investors.

Should investors in Naira-denominated Nigerian markets have a view of global markets, in particular US markets? Quite apart from the fact that many Nigerians are invested in US bonds, the S&P500 and Nasdaq, as well as Bitcoin and Ethereum, there is the question of how US markets influence Nigeria. We can observe several things happening in US markets that have not occurred in a long time, and now is a good time to assess their impact.

Spot the connection

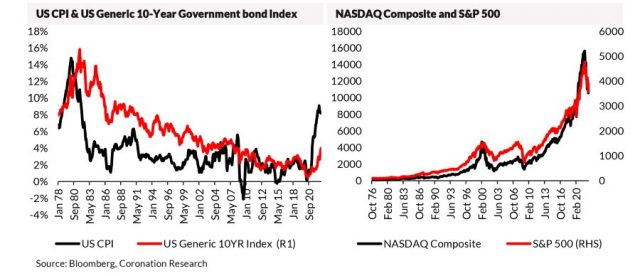

Nigerian markets do not usually correlate with global markets (far from it), but there are some important influences which show themselves during periods of market stress. Rising US interest rates (the US 10 Government bond yield has risen from 1.51% to 4.00% this year) attract investors away from African Eurobond markets and cause the yields on Nigerian Eurobonds to rise (e.g. the yield of the Federal Government of Nigeria 2027 Eurobond has risen from 6.52% to 13.58% this year). This has a knock-on effect on Naira interest rates; the FGN finds it nigh-impossible to borrow in the US dollar Eurobond markets and needs to borrow more in Naira, forcing rates upwards (the yield of a 5-year FGN bond has risen from 12.27% to 14.27% this year).

Are US rates going to continue rising, or have they peaked and are they about to fall? Our approach is to take a very long-term view of this issue, going back to the period immediately after 1978, the last time when US monetary authorities found it difficult to tame inflation. These data indicate to us that the US Federal Reserve is currently ‘behind the curve’ in tackling inflation (i.e. is reactive to it) which suggests more policy rate rises are on the way and the US government 10-year bond yield could rise further. Conversely, it could transpire that US inflation, for any number of reasons (to do with economic weakness and weak demand) falls soon, removing the risk of rising US rates: this is not our base case.

Next, what are the implications for US equity markets? Several hundreds of millions of dollars are paid to a small army of US equity strategists and analysts every year to figure out the answer, so perhaps it shows chutzpah for a Nigerian research unit to address the question. Never mind, there are some important phenomenon worth noting.

The first is that post-2008, US bond yields fell steadily in response to quantitative easing (QE) and cuts in the Federal Funds rate (though these were raised occasionally). Equity markets enjoyed a very long bull run and equity market gains – look at the steepness of the equity charts towards the right-hand side – got better in successive years approaching the end. Bond rates directly affect equity valuations, so a re-rating of equities is taking place.

Second, some of the great disrupters among the internet stocks are looking more ordinary today than they used to. Facebook (its price is up 234% over 10 years but is down 72% this so far this year) points to a slowdown in US advertising expenditure for its disappointing Q3 results. It looks more like a traditional advertising stock (think WPP or Publicis) than a disrupter at the moment. Other companies across a broad spectrum (from Boeing to Samsung) report data consistent with a slowdown in personal and company purchasing power.

Some US strategists interpret these data as showing the effects of rising interest rates feeding through into an economic slowdown, which gives a degree of visibility as to when interest rates will peak and when the economic slowdown will end (perhaps in mid-2023), and which hints that equity markets may be supported (because equity markets typically anticipate economic recoveries).

After three quarters of a year in a bear market, the bulls and the bears will argue the case for buying equities now, exactly when the news flow and the immediate outlook are extremely bleak. Our point is that successful long-term investors buy value when they see it and hold on: timing the market’s low point is just too difficult.-With Coronation Research

Twitter-@theGBJournal| Facebook-The Government and Business Journal|email: gbj@govbusinessjournal.ng|govandbusinessj@gmail.com