…Around the world equity markets are falling, particularly in the US and more particularly in Japan.

…How are we to understand this from a Nigerian perspective? First, we recall that Nigerian markets do not correlate with global markets.

…Second, when we consider that the turmoil may well bring about a lowering of US interest rates, the implication are actually positive for Nigeria.

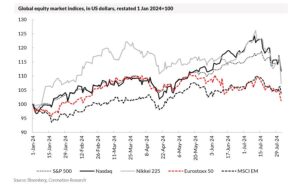

TUE AUG 06 2024-theGBJournal|The past few weeks have seen a sell-down in global equity markets, with both the US S&P 500 and the Nasdaq Composite Index falling sharply.

The biggest casualty has been Japan’s Nikkei 225 Index that, as of last Friday, had fallen by 10.3% (in US dollar terms) over a calendar month. Yet, with one important caveat, the fall in developed markets is likely to prove good for emerging markets and positive for Nigeria.

To begin with, look at the MSCI Emerging Market Index. This US dollar-based index of emerging equities has been trending upwards, albeit gently, for most of this year. It is a clue that when US interest rates are falling there is a tendency for emerging markets to pick up.

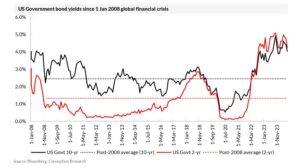

High US interest rates suck money out of risky markets, notably emerging markets. When US risk-free rates are high, and especially when they are above the level at which the market thinks future US inflation will settle, there is a tendency to keep money in risk-free US dollars.

In the chart below we track 2-year and 10-year US Government bond yields, and we draw your attention to: a) the fact that these rates are far above their long-term averages; b) they look set to fall back down towards their long-term averages by the end of this year. If this happens it will be good news for emerging markets.

Why are global markets falling so quickly, and in such an apparently synchronised way? The answer is that global investors have become, very suddenly, nervous about global growth and are interpreting such data as the recent non-farm payrolls data in the US in a negative light.

Whereas a few weeks ago weak US economic data might have spurred markets (suggesting that the US Federal Reserve would hurry to cut interest rates, making risky assets more attractive than before) today they dampen markets (suggesting that too-high rates are likely to cause a US recession).

Markets are fickle, interpretations of data change. And US markets were not helped by a spate of disappointing second-quarter results from tech firms during July.

Overall, we believe that US Government bond rates need to fall before investors become serious about buying emerging market assets again.

If money is taken out of US equity markets now and invested in US Government bonds then rates will fall. The relative attraction of emerging markets, and Nigeria, will start to improve.

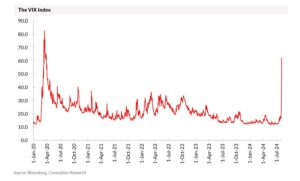

One important caveat is that investors’ appreciation of risk, as expressed by the VIX Index in the US, has shot up. Perhaps this shows that US investors will become ultra-cautious. But the spike in the VIX Index, which measures the cost of taking insurance against falling US markets, is exactly that, a spike.

Its long-term history (our chart starts in January 2020 and takes in the Covid-19 pandemic) suggests that these spikes tend to level out with time. In our view the most important influence is the US Government bond market, and here the news is good.-Analysis is written by Coronation Research and made available to theG&BJournl.

X-@theGBJournal|Facebook-the Government and Business Journal|email:gbj@govbusinessjournal.com|govandbusinessj@gmail.com