WED, JUNE 14 2023-theGBJournal |During his inaugural address on 29 May President Bola Ahmed Tinubu announced the end of fuel subsidy.

Subsidies for petroleum are believed to have cost the government in the region of US$9.0bn last year. We believe that fuel prices are now fully liberalised, i.e. they reflect market prices, including a market price for wholesale fuel and a market price for foreign exchange.

In our report, published last Friday, we checked this assumption using a Premium Motor Spirit (PMS) pricing template and seeing how it applies to the petroleum prices announced by the NNPC for 31 May.

The two principal variables in the pricing template are European wholesale petroleum prices and the Naira/US dollar exchange rate. Since we know the European wholesale petroleum price (available from Bloomberg, among other sources) we can derive – we have to say approximately – the implied Naira/US dollar exchange rate.

Note that fuel subsidy was not a cash payment but an opportunity cost of what would have been realised for Nigeria if the country had not entered into swaps (of barrels of oil) for imported petroleum products.

That budgeted cost had an implied exchange rate, which was the official (I&E Window)rate. The question is what the implied exchange rate is now.

A necessary caveat when using this method is that information is scarce and is not up to date, therefore we have used several bold assumptions to update the template ourselves.

Nevertheless, we are satisfied that our assumptions are reasonable and that the exchange rate implied by newly-announced petroleum prices is much closer to the parallel market rate (which, according to various sources is around N750/US$1) than the I&E Window rate (of N472.5/US$1).

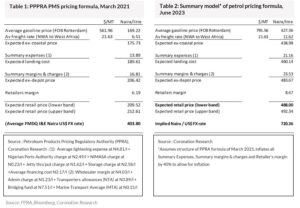

The table on the left hand side represents a summary of the actual Petroleum Products Pricing Regulatory Agency (PPRA) template from March 2021, the most recent we can locate.

The European wholesale price is given as US$561.97 per metric tonne (MT) and the exchange rate is the I&E Window rate (at that time) of N403.80/US$1.

The table of the right hand side represents the same calculation, reproduced by us, with the important additional caveat that the formula may well have changed since 2021.

And we have increased key expenses, margins and charges by a notional 40% to allow for inflation. This time the European wholesale price is US$795.56 per metric tonne.

And the implied exchange rate is much closer to the parallel exchange rate than the I&E Window rate. The price of petroleum appears to be fully liberalised.-With Coronation Research Weekly update

Twitter-@theGBJournal|Facebook-the Government and Business Journal|email:gbj@govbusinessjournal.com| govandbusinessj@gmail.com