…All the same, the Eurobond market has responded positively to these developments and the average yield of the FGN Eurobonds featured in our charts (next page) has reduced by 0.53 percentage points (53bps) over the past month.

…But this come against a backdrop of bleak news from Nigeria in July that send yields up 69bps between mid-July and mid-August.

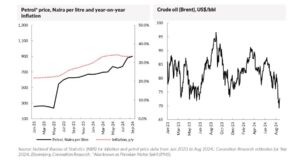

WED SEPT 18 2024-theGBJournal| Nigerian petrol prices moved up sharply in late August and early September, from an average of N771/litre in July to recently-recorded prices of some N868 – N 1,200/l (observed in Lagos).

The spread between recent prices represents the difference what is charged by stations owned by the NNPC (Nigerian National Petroleum Company) at N868/l, and what is charged by some privately-owned petrol stations.

Drivers are looking at a price increase of between 12.7% and 55.7% over two months. We have observed the highest prices cooling off over the past week, which suggests that prices around N1,200/l may have been opportunistic. Many drivers report buying petrol at N868/l over the weekend.

There are implications for:

• The Federal Government’s fiscal balances – positive

• Federal Government of Nigeria (FGN) eurobonds – positive

• Inflation – negative

• Consumer spending – negative

• Company profitability – negative

• Petroleum marketing companies – positive

Implication for government finances

The implications for the Federal Government of Nigeria’s budget are positive, though we note that the recent price move is not large enough to eliminate the fuel subsidy entirely.

The landing cost for petrol is given as between N1,100/l and N1,200/l, so a price of N868/l still implies a government subsidy of N232 – N332/l.

The administration of President Bola Tinubu announced the elimination of fuel subsidy at the end of May 2023.

The removal of fuel price subsidy in 2023 was incomplete, clearly, and even the recent price increase does not remove it entirely.

Implication for FGN Eurobonds

All the same, the Eurobond market has responded positively to these developments and the average yield of the FGN Eurobonds featured in our charts (next page) has reduced by 0.53 percentage points (53bps) over the past month.

But this come against a backdrop of bleak news from Nigeria in July that send yields up 69bps between mid-July and mid-August.

A proposal for a supplementary government budget of N6.2 trillion ($3.9 billion), coming on top of the 2024 budget of N26.0 trillion, was made in early July. Later in the month it was announced that the minimum wage would rise from N30,000 to N70,000/month (US$44.5/month).

Then came the proposal that the limit on so-called Ways and Means loans, which comprise unfunded lending from the Central Bank of Nigeria to the FGN, is to be

raised in 2025 from the equivalent of 5.0% of government revenues to 10.0%.

Next came the news that Fitch Ratings had taken its rating of Dangote Industries down to B+, citing currency losses in 2023 and ‘significant deterioration in the group’s liquidity position’.

On balance, we believe that the recent fuel price rise ameliorates, but does not reverse, the bad news on government finances in July. We continue to favour short-dated FGN Eurobond maturities, notably the November 2025 bond with a recent mid-yield of 7.6%.

Implications for inflation, consumers and companies

The rise in petrol prices has negative implications for Nigerian inflation. Even if the rise in petrol prices over the past two months is only 12.7%, and even if these prices hold, this represents a significant blow to transportation costs and inputs across the board.

Year-on-year inflation fell from 33.40% in July to 32.15% in August, but further steep declines are likely to be impeded by the rise in petrol prices. All the same, we expect the rate of inflation to moderate towards the end of the year.

Implications for fuel marketing companies

When the removal of fuel subsidy was first announced in 2023, it was clear that petroleum marketing companies would be beneficiaries.

The thesis is that, in a deregulated market, the margins charged by petroleum marketing companies are no longer set by the regulator, and therefore will rise.

Again, the market has drawn the same conclusion, marking up the prices of these companies in a short space of time.

Conclusions

The rise in fuel prices over the past few weeks is a transfer from the petrol-buying public to government. One pays more for fuel while the other reduces the sum it spends on subsidies.

The process is not complete, and the benefits for the government’s fiscal balances may not counter-balance its other problems. The market has been quick to react, and will likely react again if fuel subsidies are removed entirely.

Analysis is written by Coronation Research and made available to theG&BJournal

X-@theGBJournal|Facebook-the Government and Business Journal|email:gbj@govbusinessjournal.com|govandbusinessj@gmail.com