TUE 05 APRIL, 2022-theGBJournal| In the first quarter of 2022 Nigeria’s money markets proved to be liquid with the result that institutional investors subscribed in high volumes to Nigerian Treasury Bill (T-bill) and Federal Government of Nigeria (FGN) auctions; and they were equally active in the secondary markets.

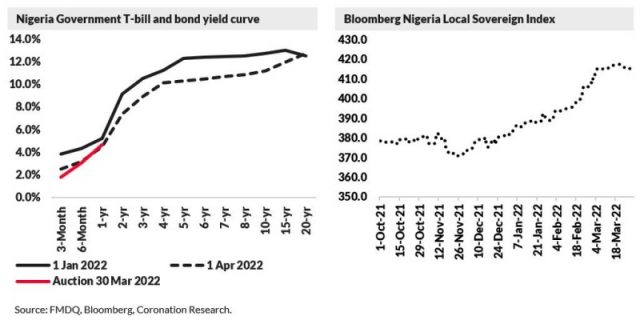

Overall, the secondary market yield for a 1-year T-bill fell by 0.76% (to 4.48% per annum) while the secondary market yield for the average of our basket of FGN bonds fell by 1.61% (to 10.21% pa).

What does this mean in terms of mark-to-market performance of Naira-denominated bond funds (often known as Fixed Income Funds)? We would expect the best ones to have recorded a mark-to-market gain in excess of 5.0% during the first quarter, given the downward move in interest rates. While the data for the various funds is still being submitted to the regulator, we can look across to Bloomberg for an indication of what performance numbers will look like.

The Bloomberg Nigeria Local Sovereign Index tracks a basket of Naira-denominated FGN bonds, using the mark-to-market convention. This is the correct convention for measuring bond performance and it is mandated by Nigerian securities regulations. Over the past six months the index is up 9.47%, but most of this performance is attributable to the past three months, when the index rose by 8.50%.

Why has it risen so much when we expect the best-run Nigerian funds to have gained slightly in excess of 5.00% (in mark-to-market price) so far this year? The reason is that the Bloomberg basket has much longer duration than most (if not all) Nigerian

Fixed Income Funds.

And long duration makes a portfolio volatile, with big price swings in its underlying bonds as interest rates change. Over 50.00% of the Bloomberg basket has duration over five years, with almost 40.00% having duration over 10 years. Most Fixed Income funds, by contrast, benchmark around six years, we believe.

What of the rest of the year? Our view is that market interest rates will begin to move upwards as the effects of high FGN borrowing are felt. We therefore expect the yield curve to trend back up again. If this happens then we would be looking at a double-edged sword: there could be mark-to-market losses in Fixed Income Funds (those that actually report mark-to-market, that is) but, with rates rising and becoming increasingly attractive to investors, the funds may attract further inflows. The rest of the year will bring changes and opportunities.-Analysis provided by Coronation Research

Twitter-@theGBJournal|Facebook-The Government and Business Journal|email: gbj@govbusinessjournal.ng|govandbusinessj@gmail.com