TUE. 21 FEB, 2023-theGBJournal| How should investors react to the fact that the equity market has risen during the first seven weeks of the year? Or, more particularly, how should investors react to a January rally? Past January rallies offer an important guide.

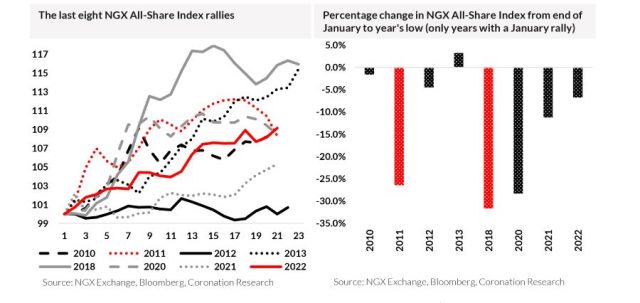

To begin with, January rallies are quite common, but they are by no means the rule. Over the past 14 years, there have been eight January rallies, so they have occurred just over half (57%) of the time.

On six of these eight occasions (75%), the market went on to post a full-year gain that was, in every case, greater than what was achieved in January. So, at first sight, it seems sensible to hold onto January’s gains.

There are two important qualifications to this view. First, while six out of eight January rallies went on to become full-year rallies, there were two that were followed by market reversals, and the experience of holding onto equities after January was costly. In 2011 the discovery of a large non-performing loan in the oil marketing industry cast a shadow over the banking sector and depressed the market as the year wore on (in those days the major telecoms companies were not listed, so the effect of bank stocks on the overall market was greater than it is now).

The January rally of 2018 followed the extraordinary rally of 2017 (in 2017 the foreign exchange crisis was finally resolved and money flowed into the country again) but this turned out to be a case of irrational exuberance: earnings growth was mediocre and market interest rates rose from mid-year onwards, taking investors away from equities.

The second point is that in every year after a January rally, with the exception of 2013 (the market kept on going up after January that year), it was possible to buy the market more cheaply later on in the year. Of course, in 2011 and 2018 there was little point in doing this (these two years are highlighted in the bar chart); but in five cases it was possible to sell in January, enter the market at a lower level later in the year, and make more money by year-end.

Should investors do this now?

The problem is that it is difficult to time the reinvestment (the post-January low was not reached until 8 November last year, for example) and quite often, the money to be saved by doing this would have been outweighed by holding onto equities and collecting dividends, which in recent years have given approximately an extra 5.0% gross to pure stock price returns, on average.

This argues for holding onto stocks after a January rally. As elections approach, the equity market does not seem to be in any way nervous (see our study of past elections in Coronation Research, Investment Outlook, Better times in 2023, 11 January).

There is a possibility that the equity market could be nervous over the coming weeks, but the post-election period coincides with the season for recording and paying full-year dividends. If the market does turn out to be nervous over the election period then short-term weakness would provide a buying opportunity a little later on, in our view.

So long as there are no good reasons for the equity market to fall (as there were in 2011 and 2018) January rallies have a habit of becoming full-year rallies.-Provided by Coronation Research

Twitter-@theGBJournal| Facebook-the government and Business Journal|email:gbj@govbusinessjournal.ng|govandbusinessj@gmail.com