WED MAY 22 2024-theGBJournal| Faced with a sharp naira slump since mid-April and 28-year high inflation of 33.69%, the MPC had little choice but to increase the Monetary Policy Rate (MPR) by 150 basis points, bringing it to 26.25% in a move to help restore price stability and positive real rates.

This hawkish stance is designed to combat soaring inflation and stabilize the naira. While the recent moderation in monthly inflation figures offers a glimmer of hope, the persistent rise in headline inflation remains a significant concern.

Despite the challenging economic climate, the CBN’s steadfast stance against inflation carries potential risks, including businesses struggling with rising production costs, diminishing demand, forex crises, and other pertinent challenges that may lead to the gradual erosion of economic vitality.

During the 295th MPC meeting held on May 20th and 21st, the committee also voted to maintain the asymmetric corridor at +100/-300 around the MPR, retain the Cash Reserve Ratio (CRR) for commercial banks at 45.00%, and keep the liquidity ratio steady at 30.00%.

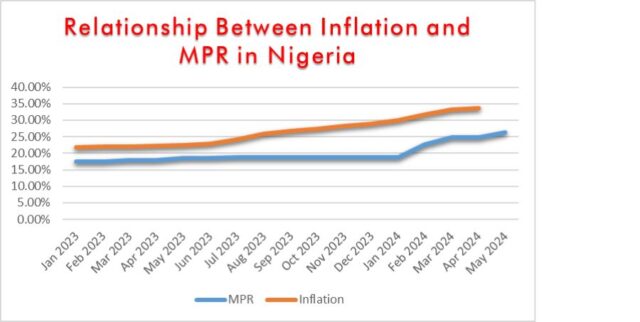

Nigeria’s relationship between interest rates and inflation is anything but straightforward. Conventional wisdom suggests that higher interest rates should curb borrowing, reduce available credit, and ultimately lower inflation. However, the empirical evidence in Nigeria, as highlighted in the accompanying graph, tells a different story.

The connection between interest rates and inflation in Nigeria is complex and unpredictable. While rate hikes are intended to control inflation, their impact can be slow and uncertain. Various other factors, such as supply chain disruptions and global food price increases, also play significant roles in driving inflation.

In the short term, the effectiveness of rate hikes would be directed to attracting dollar inflow and strengthening the currency, as Nigeria is import-dependent. When the exchange rate strengthens, inflation should reduce.

Analytical Perspective:

Interest Rates and Borrowing Costs:

Conventional Theory: Higher interest rates typically lead to increased borrowing costs, which in turn reduces consumer spending and business investments, leading to lower inflation.

Nigerian Context: The transmission mechanism of monetary policy in Nigeria may be impaired by structural issues within the financial sector, such as limited access to credit for small and medium enterprises (SMEs) and a significant informal economy.

Currency Value and Inflation:

Dollar Inflow: By raising interest rates, Nigeria aims to attract foreign investment, which can increase the demand for the Naira, thereby strengthening the currency.

Import Dependency: A stronger Naira can make imports cheaper, potentially reducing imported inflation. However, this effect is contingent on stable global commodity prices and effective foreign exchange management.

Supply Chain and External Factors:

Global Food Prices: Nigeria is susceptible to fluctuations in global food prices. Supply chain disruptions, whether due to geopolitical tensions or global economic shifts, can exacerbate inflation irrespective of domestic interest rate adjustments.

Local Production: Enhancing local production and reducing dependency on imports could mitigate the impact of external price shocks, but this requires long-term investments in infrastructure and capacity building.

Policy Implementation Lag: The effects of interest rate changes on inflation are not immediate. It often takes several months for monetary policy adjustments to permeate through the economy.

Increased Loan Defaults: Businesses and individuals may struggle to service loans as interest rates rise, potentially leading to an increase in non-performing loans for banks.

Stagflation Risk: There’s a risk that the rate hike could slow economic growth without effectively controlling inflation, leading to stagflation (stagnant growth with high inflation).

Bottom Line

The Apex Bank’s rate hike is expected to exert increased strain on the economy, particularly on businesses. The economy, already grappling with numerous social and economic challenges, may face further destabilization. An increase in the minimum cost of borrowing could slow down the corporate sector, potentially leading to a decline in the stock market.

Additionally, the recent interest rate hike is expected to stimulate activity in the fixed-income market by making new securities more attractive. New bonds will be issued with higher yields to reflect the increased policy rate. Investors will demand higher returns to compensate for the elevated interest rate environment.

As a result, long-duration bonds, which are more sensitive to interest rate changes, are likely to experience greater price declines compared to short-duration bonds as rates rise.

On the macroeconomic front, the increased interest rate may slow GDP growth and hinder stock market appreciation. Furthermore, this policy could exacerbate the unemployment issue facing the Nigerian economy. Despite these challenges, there is a slim possibility that inflation rates may ease somewhat by the end of the year.-Analysis is written by Comercio Partners Research and made available to theG&BJournal

X-@theGBJournal|Facebook-the Government and Business Journal|email:gbj@govbusinessjournal.com|govandbusinessj@gmail.com