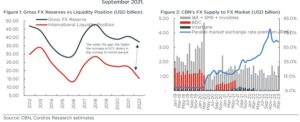

TUES, AUGUST 15 2023-theGBJournal |Using the gross FX reserve (USD 33.88 billion) as of 10 August and holding the pre-determined contactual foreign currency obligations or net short-term drains (FCD) constant, analysts at Cordros Research estimate that the CBN’s liquid reserves are currently USD11.87 billion (or 35.0% of gross FX Reserves as of 10 August).

”The low international liquidity position clarifies why the CBN’s FX supply to the official windows has been underwheiming in the past three years even when the gross FX reserves settled as high as US41.57 billion in September 2021,” Cordros said in its analysis of recent CBN account.

The significant implication of the low CBN’s international FX liquidity position is that the apex bank’s FX intervention to support the domestic currency will remain underwhelming until there is a significant FX inflow to the CBN and the economy.

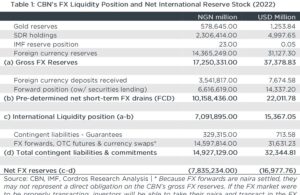

Before now, there have been divergent opinions on the actual state of Nigeria’s FX reserves, given that the CBN only publishes the gross FX reserves without comprehensive information on FX liabilities.

However, the CBN’s 2022 financial statement has now allowed us to analyse the country’s international FX liquidity position and net reserves using the IMF’s standardised methodology.

Based on the recently released CBN’s 2022 financial statement, the apex bank’s foreign currency liquidity position is exceptionally lower than the gross FX reserves as of end 2022.

The preceding will likely erode foreign investors’ confidence in the economy.

Asides from the aforementioned, given that foreign investors have chosen to remain on the sidelines amid the current prohibitively low domestic interest rates and export earnings remain low, it is expected that the naira will remain on the backfoot and depreciate further against the US dollar in the near term.

The expected lingering exchange rate pressure also implies that domestic inflationary pressures will be sustained over the rest of the year, more so that PMS prices are expected to remain high.

Given the CBN’s low international foreign currency liquidity position, foreign investors may demand higher yields on Nigeria’s sovereign instruments, making the country’s external borrowing costs remain prohibitively high.

Meanwhile, on 10 August, the CBN auctioned its first OMO bills since 29 December 2022.

Despite the high subscription level relative to the offer (Bid-offer ratio: 2.1x), the stop rates averaged 12.49% across the 96-day (10.00%), 187-day (12.98%), and 362-day (14.49%) bills – exceptionally higher than 8.50% mean level at the December 2022 auction.

Although it is still in the early stages, analysts think this auction represents one of the short-term fixes for the CBN to attract FPIs into the market amid concerns that the Treasury bills yields are too low to attract foreign investors.

Cordros whilst refelcting on the auction said they are cautiously optimistic that active OMO operations with competitive interest rates will complement recent FX reforms and may be a short-term fix needed to bring FPIs back to the FX market.

”The preceding suggests a bifurcation of interest rates where rates are high for foreign investors (OMO bills) but low for domestic investors (Treasury bills) following the DMO’s efforts to keep borrowing costs low,” Cordros said.

”Moreover, bringing back OMO as a tool for attracting foreign investors takes us back to the unorthodox monetary policy era. It will come at a considerable cost to the CBN’s balance sheet.”

Asides from the lack of will to approach the IMF for funding assistance, Nigeria’s unwillingness to embark on currency and fiscal reforms has been at the core of the reasons the country has been unwilling to meet the IMF for funding support.

Thus, given that the government is rapidly churning out reforms after embarking on FX and PMS subsidy reforms, Cordros believes this is the perfect opportunity for the country to approach the IMF for funding support.

”In this instance, the government will not need to do much as the majority of what the IMF will demand, as conditions are what the country is already embarking upon. In our view, removing gasoline subsidies and floating the currency without plans to boost the FX supply in the short term will take the country back to where it was before the reforms,” Cordros said.

Indeed, recent developments in the FX space suggest the CBN is managing closing rates at the official FX market, given that the exchange rate, in recent times, has been trading within the N740.00 – N780.00/USD band despite the meagre FX supply relative to demand.

Over the medium term, diversifying the economy’s export base is paramount to solving the reoccurring exchange rate issues. Nigeria needs to look beyond crude oil and earn more from stable exports – it is non-negotiable.

Twitter-@theGBJournal|Facebook-the Government and Business Journal|email:gbj@govbusinessjournal.com| govandbusinessj@gmail.com