…This raises two question. First, what has driven these rates upwards? Second, how long will they be at these levels?

…If our analysis is correct, and barring a change in policy (we hope not), 1-year T-bill rates over the 20.00% are likely to prevail for a while.

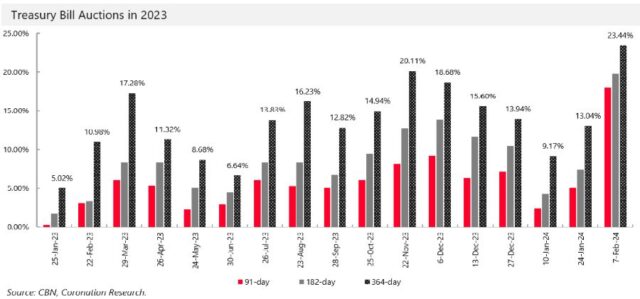

TUE, FEB 20 2024-theGBJournal|Regular readers of the Coronation Research Nigeria Weekly Update may be surprised by the 1-year T-bill rate. For the second week in a row it is over 20.00% per annum.

While this falls short of the inflation rate at 29.90% per annum (for January) it is much better than 1-year T-bill rates available for most of 2023, and better than rates available earlier this year.

This raises two question. First, what has driven these rates upwards? Second, how long will they be at these levels?

The first question is easy to answer. The Central Bank of Nigeria (CBN) signaled its intention to raise market interest rates back in November, both through auctions of its OMO bills (bought by banks and available to foreign investors) and through auctions of T-bills.

Those auctions saw 1-year T-bill yields briefly exceed 20.00% but then yields at auction fell again during December, even though yields of 1-year OMO bills were maintained above the 20.00% mark. January also saw some low 1-year T-bill yields.

That has changed in February. During his interview with Arise News on Monday 5 February, CBN Governor Yemi Cardoso laid out his plans to tackle the backlog in the foreign exchange markets (see Coronation Economic Flashnote, 5 February).

We highlight three of the points he made about Naira interest rates. First, he said that the Central Bank would concentrate on stabilising prices (something he had said before, in October).

Second, he said that the CBN would welcome foreign portfolio investment (for example, if foreign investors buy OMO bills).

Third, he said that foreign investors are very interested in participating in the Nigerian market.

All this seems consistent, in our view, with 1-year OMO and 1-year T-bill rates over 20.00%. The T-bill auction on 7 February took 1-year yields to 23.44%. It seems that – for whatever reason – the strategy of having high T-bill yields could not be sustained in December and January but has been re-launched with vigour in February.

Domestic investors who might have shunned the Naira fixed income markets last year are being offered much better value than they were before.

And foreign investors could also be tempted to come back to the Naira fixed income markets (although they would need reassurance on US dollar convertibility on exit, in our view).

How long will this continue? It seems to us that the CBN has consolidated its position and its approach to public finances. Recently the Governor announced that the CBN would no longer grant so-called ‘Ways and Means’ loans to the Federal Government, which was a way of financing government with the balance sheet of the CBN, something to which many economists attribute Nigeria’s current inflation problem.

To use market interest rates to tackle inflation and to set interest rates at a level that may attract significant long-term saving are the hallmarks of a central bank intent on creating price stability.

This points to a sustained period of high rates, in our view, because the effects can only be measured over several quarters, rather than months.

If our analysis is correct, and barring a change in policy (we hope not), 1-year T-bill rates over the 20.00% are likely to prevail for a while.

From Coronation Research Nigeria Weekly Update

X-@theGBJournal|Facebook-the Government and Business Journal|email:gbj@govbusinessjournal.com|govandbusinessj@gmail.com