…Savers are the big beneficiaries here. T-bill and FGN bond investors have dealt with miserable rates for most of 2023 (as, indeed, they have done since November 2019) with interest rates nowhere near the rate of inflation.

TUES, NOV 28 2023-theGBJournal| Actions speak louder than words. We heard no official announcement that market interest rates would rise, but market interest rates, notably Nigerian Treasury Bill (T-bill) rates, are rising decisively. No official person – to our knowledge – has made a speech on the need for higher market interest rates, but rates are going up anyway.

We first saw this happening in the open market operations (OMO) of the CBN in October. OMO bill auctions are a way of managing liquidity in the financial system and they influence T-bill rates.

As we argued in Nigeria Weekly Update, On our way to better savings?, 6 Nov 2023, the rise in OMO rates would likely lead to a rise in T-bill rates. This prediction worked out but our other prediction, namely that the meeting of the Monetary Policy Council (MPC) on 21 November would provide us with guidance on interest rates, was not as good.

The MPC did not meet last week, just as it had not in September, leaving the meeting back in July (meetings are scheduled every two months) as its most recent one.

One likely explanation is that the CBN is much more concerned with managing the backlog of demand for foreign exchange than with official rate-setting (see Nigeria Weekly Update, A US$ boost for Nigerian markets?, 30 Oct 2023).

And it is just possible, we believe, that the monetary authorities currently prefer not to pronounce on interest rates, given the sensitivity (felt by borrowers, above all) of market interest rates going up: better to act than to speak.

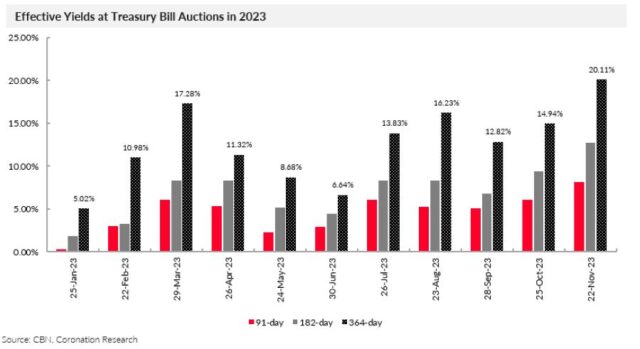

Savers are the big beneficiaries here. T-bill and FGN bond investors have dealt with miserable rates for most of 2023 (as, indeed, they have done since November 2019) with interest rates nowhere near the rate of inflation.

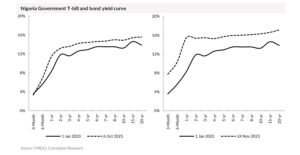

For much of this year T-bills have carried single-digit yields, though there were some relatively good times in March, July and August. Now it looks as though OMO and T-bill auctions are effectively coordinated to produce 1-year T-bill yields at auction in the region of 20.00% per annum. This is still well short of inflation at 27.33% pa, but much better than rates seen earlier this year.

What makes us think that these rates will stick? Our first argument is that the raising of OMO rates and the allocations by the CBN at recent T-bill auctions, as well as the allocations by the Debt Management Office (DMO) at recent FGN bond auctions, appear coordinated. This looks like policy in action. Second, in late October, CBN Governor Dr. Yemi Cardoso stated (in a rare public speech) that the CBN would be seen to be taking price stability very seriously. We think this is what he means.

Could rates go higher still? It is not always necessary to take market interest rates above the rate of inflation in order to tame inflation. So, it is possible that the CBN will let market rates settle where they are now and observe their effect, combined with the de-bottlenecking of the foreign exchange market, on inflation, and adjust accordingly.

Whether market interest rates have reached a plateau, or whether more rises are on the way, we believe these rates are far better than what has gone before and well worth holding in the short term.Analysis is provided by Coronation Research

X-@theGBJournal|Facebook-the Government and Business Journal|email:gbj@govbusinessjournal.com| govandbusinessj@gmail.com