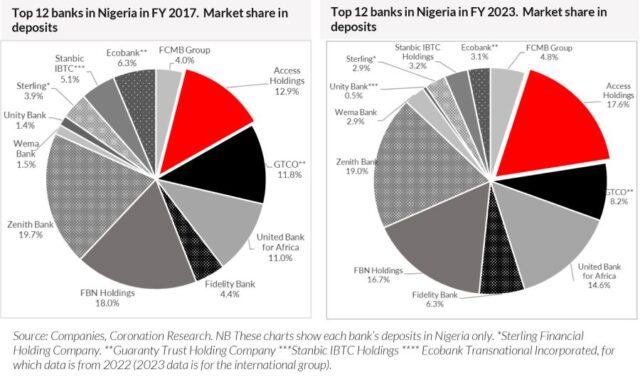

…Access Holdings has one of the biggest footprints in Africa, with some 60 million customers, having grown from obscurity 22 years ago to become, in our opinion, one of the top-2 banking franchises in Nigeria

…At FY2023 20% of its assets and 26% of its equity were in its UK subsidiary, The Access Bank UK, with a high weighting to short-term (trade finance) loans

…It is no flag-planter: in its 13 African countries (ex-Nigeria) it ranks top-5 by Pre-tax Profits in six of them, top-10 in 10 of them

SAT JULY 06 2024-theGBJournal| In the context of Access Holdings’ capital raising program (announced in 2023) and its recently-announced 1:2 rights issues, we believe that its current valuation represents an attractive entry point into a diversified pan-African and global growth story.

Access Holdings trades at 0.31x its book value.

To the extent that (a) its book value is likely to increase with time (retained earnings), (b) the market in future decides to rate its shares more highly (its Nigerian peers Zenith Bank and Guaranty Trust Holding Company are valued at 0.41x and 0.70x price-to-book, respectively), 0.31x price-to-book appears an excellent entry point today.

How solid is the book value?

Non-performing loans stood at 3.1% of gross loans at FY2023 with a cost of risk at 1.2%, an entirely manageable sum given FY2023 Pre-tax Profits of N729.0bn (all NPLs could be written off at a cost of less than 6-months Pre-tax Profits with zero impact on book value).

In the context of Naira devaluation Access Holdings’ asset quality gets better, not worse. At FY2023 20% of its assets and 26% of its equity were in its UK subsidiary, The Access Bank UK, with a high weighting to short-term (trade finance) loans.

At FY2023 21% of its equity was spread across 13 African subsidiaries, a highly diversified and non-correlating portfolio of risk. Naira devaluation in Q1 2024 already means that close to 50% of its Net Profits are likely to come from outside Nigeria, approximately 25% from the UK, 25% from Africa ex-Nigeria. We think there is a strong case for Access Holdings’ rating breaking through the sovereign ceiling.

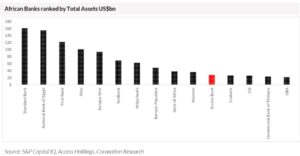

Access Bank ranks at number 11, by US dollar assets, of all African banks. It is the leading Sub-Saharan African challenger to the established South African banks and the north African banks of Egypt and Morocco, and it has reached this position over a short period of time. Given its steps to become a top-3 bank in each of the African markets (ex-South Africa) in which it operates, we forecast progress up the table.

Rather than a single-market Nigerian bank, Access Holdings deserves to be rated as a diversified frontier market investment play, with a strong weighting in the UK. Its speedy development of non-banking revenues (e.g. bancassurance commissions, with a recent CAGR of 66%) points to a comparison with a company like Brazil’s Itau. And Itau trades at an historic price-to-earnings ratio of 8.8x, compared with Access Holdings’ 1.1x.

Access Holdings has one of the biggest footprints in Africa, with some 60 million customers, having grown from obscurity 22 years ago to become, in our opinion, one of the top-2 banking franchises in Nigeria, with Zenith Bank as its principal peer.

Beyond establishing itself as a top-3 bank in each country, the intention is to roll out the wealth strategy currently being implemented in Nigeria. This means bringing its bancassurance, pensions, and payments businesses to these markets, and orchestrating its strategic partners in telecoms, asset management, general insurance, life insurance, private banking, wealth management, and trustee businesses, bringing long-term wealth and insurance solutions to ten of millions of Africans.

To our knowledge, no other financial services group is attempting anything as far-reaching and ambitious.

There are many factors in its rapid development, and although we cannot cover even a small part of the ground here, we note among significant milestones: the first Nigerian bank to commence the use of Visa credit cards in Nigeria (2007); the takeover and complete recapitalisation of Intercontinental Bank (2012); the launch of a US$350 million Eurobond (2012); the designation of a Significant Important Financial Institution by the CentralBank of Nigeria (2014); and the takeover of Diamond Bank (2019).

It is no flag-planter: in its 13 African countries (ex-Nigeria) it ranks top-5 by Pre-tax Profits in six of them, top-10 in 10 of them.

It aims to be a top-3 bank in each market (ex-South Africa) through a combination of organic growth and acquisitions. Yet, these subsidiaries are mainly profitable, lowering the strain on group capital.

Trade finance is a growth area for the entirety of Access Bank and its international subsidiaries. The scaling-back by the largest international banks of their emerging market trade finance operations, not to mention the closure of

some of their local African operations, results from their strategy of de-risking.

For some of these international banking giants, reinsuring Nigerian letters of credit was once a significant business. Their partial (or in some cases

total) withdrawal from African trade finance provides Access Bank with a golden opportunity, in our view.

Access Bank has a strong franchise in retail banking, with close to 60 millions retail customers, and its monetisation is being driven by technology. As adoption of tech increases, Access Bank in enjoying rapid growth rates in areas such as mobile and internet banking and USSD. Credit card transactions also provide a significant growth driver.

Access Bank’s transaction count in Mobile & Internet banking grew at a CAGR of 52.0% between 2020 and 2023, to reach over 1.0 billion. Its transaction count in USSD rose at a CAGR of 24.4% over the same period to reach 1.1 billion.

Transaction volumes have also been growing swiftly, with Mobile & Internet banking transaction volumes growing at a CAGR of 42.2% between 2020 and 2023, and Debit & Credit card transaction volumes growing at a CAGR of 17.6% over the same period.

The Access Bank UK is a springboard for Access Holdings to reach into several new markets, starting with Paris and Dubai (both branches) and an office in Hong Kong. Access Bank also has offices in the Republic of China, Lebanon and India.

The company has a strong culture, with continuity among its senior management. A decade with the company is not unusual among its senior executives, over two decades in the case of the current managing director. The culture is to expand the business aggressively while maintaining a tight rein on costs. It has a rigorous training and retention program honed over many years.

Tech-driven growth and wealth partner

As a strategic avenue, technology has not eluded Access Holdings. It considers several hundred tech investments annually, picking a few to back. Its investment in payments service provider Hydrogen, is proving a winner with over N11.0 trillion of payments processed in 2023.

Access Pensions: acquisition strategy

Access Holdings owns 53.76% of Access Pensions, Nigeria’s second-largest PFA in terms of RSA holders with some N1.1 trillion in AUM at the end of 2023. The creation of Access Pensions is the result of the merger of First Guarantee Pensions with Sigma Pension, Access Holdings having bought interests in both firms in December 2022.

In January 2024 Access Holdings announced its acquisition of a majority stake in ARM Pension Managers, the third-largest PFA by RSA holders. The acquisition is set to make Access Pensions the second-largest PFA by AUM, vying with Stanbic IBTC Pensions for first place.

In short, we believe Access Holdings is overdue a re-rate by the market in view of its growth and diversification.-Analysis is provided by Coronation Research

X-@theGBJournal|Facebook-the Government and Business Journal|email:gbj@govbusinessjournal.com|govandbusinessj@gmail.com