…Nigeria’s markets are in confident mood

TUE. 07 FEB, 2023-theGBJournal| In contrast with the run-up to general elections in 2015 and 2019, Nigeria’s markets are in confident mood in 2023, with the equity market rising and market interest rates falling.

This also contrasts with the realities on the street where we see queues at petrol stations and queues at banks where customers are trying to get hold of their new bank notes.

The equity market, in the shape of the NGX All Share Index, has risen 5.8% in the first five weeks of the year (as of last Friday).

This contrasts with its decline in the run-up to 2015’s general elections (it fell 17.4% in the first six weeks of the year) but comparable with its rise in the run-up to 2019’s general elections (it rose 4.1% in the first six weeks of the year).

In 2015 there was a lot of uncertainty about the outcome of the elections, as a challenger in shape of Muhammadu Buhari was attempting to dislodge an incumbent, President Goodluck Jonathan. The equity market clearly thought the situation was risky and there was a spike in market interest rates at the time of the polls.

The transfer of power from the incumbent to President Muhammadu Buhari turned out to be peaceful and the equity market subsequently rallied (at least for a while).

In 2023, and despite the fact that there is an unusual three-way split among the major parties (the APC, the PDP and the Nigeria Labour Party), which makes the outcome uncertain, the equity market is buoyant.

This may be because interest rates are falling. 1-year T-bill rates have fallen from 8.55% at the beginning of the year to 3.86% at the end of last week. A fall in the cost (or yield) of money is often associated with a rise in equity markets (of course, the reverse was true of global equity markets during 2022) but the relationship is not precise.

T-bill yields, fixed income yields and deposit rates are all falling in early 2023 but this has to do with the slow rate of T-bill and Naira-denominated FGN bond issuance planned for the first quarter, which means that redemptions (of old T-bills and FGN bonds) are increasing liquidity. It is the fiscal calendar, not the political outlook, which is driving down rates at the moment, in our view.

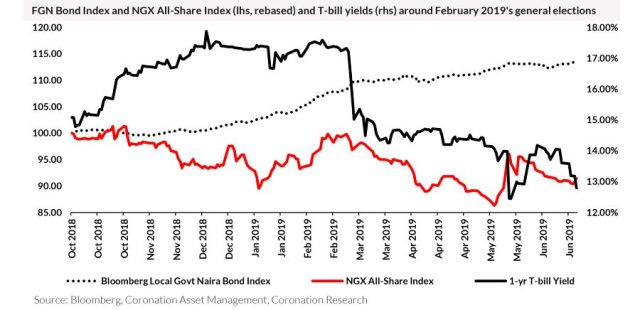

Purely political considerations appear not to be affecting the markets, so far in 2023. The situation was similar in 2019, when President Muhammadu Buhari was campaigning for his second term. The equity market, as we have mentioned, rose gently while 1-year T-bill yields did not change much during the first six weeks of the year (whereas they are falling now).

At the end of February 2019, the markets suddenly traded down the yield of 1-year T-bills, anticipating a cut in the Monetary Policy Rate (MPR) of the Central Bank of Nigeria (CBN) in March (this marked the beginning of the CBN’s long campaign to keep rates low and to increase liquidity in the economy).

In 2019 it was not the election that made 1-year T-bill yields fall, so much as the CBN’s decision to introduce, straight after the elections, a new kind of economic policy associated with low interest rates.

Could there be a repeat performance in 2023? It does not seem likely, given that the CBN is on a mission to tame inflation by raising the MPR: from 11.50% to 13.00% in May 2022, from 13.00% to 14.00% in July, from 14.00% to 15.50% in September, from 15.50% to 16.50% in November, and from 16.50% to 17.50% in January 2023. Inflation has only just begun to moderate, very slightly. A cut in the MPR would mark a reversal of policy.

A significant point about the cut in the MPR in March 2019 is that it did not spur a rally in the equity market, a fact that underlines our observation that the relationship between falling rates and rising equity values is not a reliable one.

So, what to make of the upcoming polls?

Market interest rates are falling and the equity market is strong, for reasons that are probably not to do with politics. And after the elections? While some of the parties contending the presidential election are moderate in their fiscal ambitions, others are ambitious and wish to vastly expand government expenditure (for which there would have to be adjustments in monetary policy).

These differences in political manifestos are given in Coronation Merchant Bank’s publication ‘Baton Hand-Off’ 31 January 2023.

If a party with ambitious spending plans were to come to power then we might see (we say ‘might’ because not all manifestos are translated into action) large government deficits and, possibly, very loose monetary policy (low interest rates).

These in turn could stimulate further falls in T-bill yields, a rally in the value of FGN bonds (mark-to-market), and possibly a further rally in the equity market. However, such an outcome depends on a particular outcome at the polls and on manifesto pledges being translated into action. Other outcomes are unlikely to be as clear, so it will be a matter of closely monitoring what happens.-With Coronation Research report.

Twitter-@theGBJournal| Facebook-The Government and Business Journal|email:gbj@govbusinessjournal.ng|govandbusinessj@gmail.com