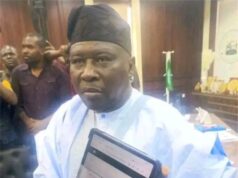

A Federal High Court in Lagos will on Nov.11, resume trial of a Managing Director of the defunct Bank PHB, Francis Atuche, standing trial over N125 billion fraud.

Atuche was charged alongside a former Managing Director of Spring Bank Plc., Charles Ojo, on an amended 45 counts.

The defendants were arraigned before Justice Saliu Saidu on Feb.20, 2014, before the judge was transferred out of the Lagos jurisdiction.

Following the transfer, the case was re-assigned to Justice Ayokunle Faji, and the defendants were subsequently re-arraigned before him on Feb. 18, 2017.

They, however, pleaded not guilty, and Faji allowed them to continue on bail granted them by Saidu.

Although, Saidu was eventually returned to the Lagos division, the case still continued before Faji.

Trial has since begun before Faji, with the prosecution giving evidence.

On June 11, a second prosecution witness, Mrs Philipa Odesi, testified about the operation of credit facilities in the bank.

The court subsequently adjourned the case until Monday for continuation of trial.

When the case was mentioned on Monday, Mr Chukwudi Enebeli who announced appearance for the prosecution, informed the court that the prosecution served subpoena, signed by the court, on Keystone Bank last week.

He said that the subpoena was for the bank to produce certain documents necessary for the trial.

He added that a representative of the bank, Mr Eze Asiegbu, was present in court.

Prosecution, however, informed the court that all the necessary documents had not been gathered, and prayed for adjournment of continuation of trial.

Faji consequently adjourned the case.

The defendants were first arraigned in 2009 before Justice Akinjide Ajakaiye.

Ajakaiye had granted them bail in the sum of N50 million each with two sureties each in like sum.

They were later re-arraigned before Justice Binta Murtala-Nyako on Feb. 3, 2012, and subsequently re-arraigned before Justice Rita Ofili-Ajumogobia on Jan. 16, 2013, following the transfer of Murtala-Nyako.

Both judges adopted the bail terms granted by Ajakaiye.

The EFCC, however, re-arraigned the defendants before Saidu on Feb. 20, 2014, following re-assignment of the case.

It re-arraigned them in Feb. 18, 2017 before Faji.

According to the charge, the defendants granted credit facilities, manipulated shares and committed general banking fraud to the tune of N125 billion.

The alleged offences contravene the provisions of Sections 7(2) (b) of the Advanced Fee Fraud Act, 2004, and Sections 15(1) of the Failed Banks (Recovery of Debts) and Financial Malpractices in Banks Act, 2004.

They also contravene the provisions of Section 516 of the Criminal Code Act, Cap C38, Laws of the Federation, 2004, as well as Section 14 (1) of the Money Laundering Prohibition Act, 200.