…Report shows the poorer you are, the less likely you are to have ID

…NIN enrolment has accelerated, with 67% growth over the past 10 months.

…However, poor, and vulnerable communities remain the least likely to have ID, and knowledge and understanding of the barrier this creates to financial inclusion and credit is growing.

WED 15 SEPT, 2021-theGBJournal- The Africa Practice Inclusion for All initiative, an advocacy programme to address the barriers that prevent the financial and economic inclusion of Nigeria’s poorest and most vulnerable communities, today releases its inaugural research into the links between poverty, identity, and inclusion.

The World Bank Group estimates that 1 billion people globally are without an officially recognised means of ID, which is most prevalent in low-income countries. Despite a significant acceleration in ID enrolment over the last 12 months by the National Identity Management Commission (NIMC) and a robust strategy to achieve ID inclusion for every Nigerian, there remains significant work to do. NIMC had enrolled more than 63 million Nigerians with National Identity Numbers (NIN) by August 31 2021, up from 42 million in October 2020 – clear evidence of progress. However, a significant proportion of Nigerians remain without a form of formal ID, and the majority live below the World Bank’s definition of the poverty line.

The Africa Practice research focuses on understanding the links that exist between income level, identity ownership and financial inclusion to identify opportunities to accelerate the pace of inclusion.

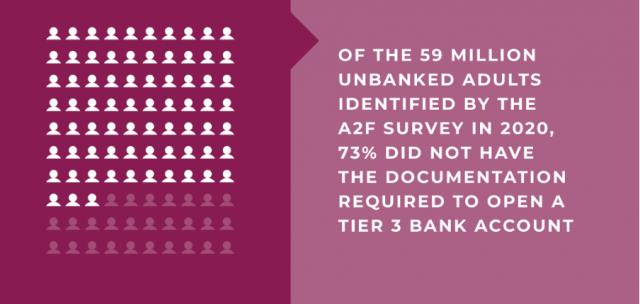

According to the Access 2 Finance survey conducted by Enhancing Financial Innovation and Access (EFInA) in 2020, 36% of Nigerian adults remain completely financially excluded, representing 38 million people, while a total of 59 million Nigerians are unbanked. Of these, 73% do not have the identity documents required to open a Tier 3 bank account.

The Africa Practice research analyses the EFInA data to understand linkages that exist between identity ownership, other demographic factors, income, and financial inclusion. The first phase of research has revealed two clear trends.

That the poorer you are, the less likely you are to have ID and that, the number of people that reference ID as a key barrier faced opening a bank account or accessing credit, increased substantially in 2020.

These preliminary findings now form the basis for further research to identify the drivers for lack of ID, and to design and deliver interventions that can support the delivery of Nigeria’s Identity Programme and Financial Inclusion strategy. The NIMC Identity Strategy clearly recognises the need to ensure that excluded populations are included in the enrolment process, and this research reinforces that need, demonstrating the urgency for action. The poorest excluded populations are most often the hardest to reach, and can be the most resistant to participation, but stand to gain the most from the range of government and financial services that inclusion enables.

These preliminary findings now form the basis for further research to identify the drivers for lack of ID, and to design and deliver interventions that can support the delivery of Nigeria’s Identity Programme and Financial Inclusion strategy. The NIMC Identity Strategy clearly recognises the need to ensure that excluded populations are included in the enrolment process, and this research reinforces that need, demonstrating the urgency for action. The poorest excluded populations are most often the hardest to reach, and can be the most resistant to participation, but stand to gain the most from the range of government and financial services that inclusion enables.

Commenting on the findings, Africa Practice Director, Tim Newbold said: “The pace of identity enrolment in Nigeria has accelerated markedly in 2020 and 2021, with more than 21 million Nigerians enrolling, and is a testament to NIMC’s strategy and government’s focus on the issue. We need to maintain this momentum and ensure that we support NIMC to achieve its objectives for enrolment of the populations that need it most – the excluded and the vulnerable. This will take innovation, skill and commitment, and we look forward to working closely with all stakeholders to achieve Nigeria’s identity and financial inclusion goals.”

Chinasa Collins-Ogbuo – Programme Lead for the Inclusion for All initiative said: “It is clear that the poorer you are, the less likely you are to have ID, and that this is increasingly being recognised by Nigerians as an obstacle to accessing financial services, particularly credit. During the COVID-19 pandemic, we know that demand for formal credit amongst vulnerable communities increased. There is an opportunity here, to focus targeted interventions on those communities where demand exists, to help them participate in the formal financial system and access the credit they need. This is going to be a core focus for us going forwards.”

To achieve NIMC’s ambitious enrolment targets by 2023, all relevant stakeholders across public, private and the grassroots must work together to ensure that the enrolment system reaches those who need access to the services the most – the vulnerable and marginalised.

Twitter-@theGBJournal|Facebook-The Government and Business Journal|email: govandbusinessj@gmail.com