…For Nigeria, the ripple effect of Trump’s policies could negatively impact the economy indirectly is we highlight that .

…This could primarily stem from global uncertainties, high global interest rates in advanced economies, and possible slump in oil prices.

TUE JAN 28 2025-theGBJournal| President Donald Trump was officially inaugurated on 20 January as the 47th President of the United States of America, marking the beginning of his second term in office.

Notably, he signed 26 executive orders immediately after being sworn in as president. While his administration has proposed a wide range of policies, this report focuses on four critical areas – tax reform, trade tariffs, immigration, and energy policies – that hold significant implications for emerging and frontier market economies.

Proposed Policies and Overall Impact

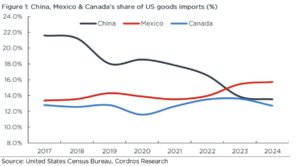

Trade Tariff: During his campaign, President Donald Trump promised significant tariff increases, with specific targets – China (60.0%), Mexico (25.0%), Canada (25.0%), and other countries (10.0%) – which were meant to be implemented on his first day in office.

However, following his inauguration, he directed federal agencies to review existing trade agreements and investigate inequitable practices by trading partners without detailing specific tariff plans. While the new administration’s commitment to raising trade tariffs remains evident, the order for a review points to a more measured and strategic approach.

Nonetheless, the eventual imposition of these tariffs is expected to negatively impact global trade, likely triggering retaliatory measures from affected countries. Higher tariffs are also expected to slow economic growth in nations heavily dependent on exports to the US, including China, Mexico & Canada.

The US itself is not immune to these consequences, as reduced imports from these countries due to higher import costs may lead to supply shortages and could potentially trigger inflationary pressures within its economy.

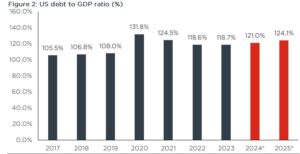

Tax Reform: Trump plans to extend his 2017 tax cuts, lowering the corporate tax rate to 15.0% (previous: 21.0%). He also proposes exempting certain wages, including earned tips, social security wages, and overtime wages, from income tax while removing the USD10,000.00 cap on state and local tax deductions, which would primarily benefit taxpayers in high-tax states, potentially increasing disposable income for many households.

The proposed tax cuts could intensify U.S. debt concerns by widening the fiscal deficit due to reduced revenue, leading to increased borrowing. At the same time, they may boost GDP growth by stimulating consumer demand but risk higher inflation if demand outpaces overall output.

Immigration: Trump promised mass deportation of undocumented immigrants irrespective of their length of stay in the US, as well as stricter border control.

While this policy is likely to primarily affect non-skilled labour, the respective sectors, including agriculture, healthcare and construction, which rely heavily on unskilled immigrants, could be affected, potentially driving up prices of goods and services produced from the affected sectors, as wage costs skyrocket.

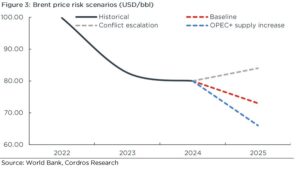

Energy: Trump plans to reverse Biden-era restrictions on oil drilling and withdraw from the Paris Agreement again – an international treaty on climate change to cut emissions.

Recall that the previous administration rejoined in 2021 after the previous Trump administration withdrew from the Agreement in 2017. The new administration intends to focus on expanding fossil fuel production while halting federal funding for renewable energy projects.

While we retain our oil price estimate of USD76.00/barrel, a higher-than-expected increase in crude oil supply from the US may likely present a downside risk to our forecast.

Lower crude oil prices are expected to push down energy prices and reduce inflationary pressures in the US and other oil-importing countries. However, major oil-producing countries could take a hit as export revenue falls.

Impact on Emerging Markets

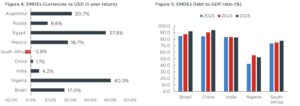

Given the heightened uncertainties, particularly regarding the potential impact of Trump’s policies on the global economy, inflows into US dollar-denominated assets are expected to remain robust, thereby sustaining the strength of the US dollar against other currencies and constraining capital flows to emerging markets.

Additionally, while the US Federal Reserve has shifted toward monetary policy easing, further rate cuts will depend on how well inflation trends downwards. However, with inflation expected to remain persistently high, driven primarily by wage growth and trade protectionism, interest rates in the US are likely to stay elevated for an extended period, limiting carry trade opportunities in emerging markets.

The risk becomes more significant if inflation in the US and other advanced economies trends back upwards beyond 3.0%. Such a scenario could prompt the Federal Reserve to resume policy rate hikes, further elevating the risk of capital flight. Furthermore, the elevated interest rate environment in the US is poised to keep foreign debt service costs high in emerging economies.

Impact on Nigeria

For Nigeria, we highlight that the ripple effect of Trump’s policies could negatively impact the economy indirectly.

This could primarily stem from global uncertainties, high global interest rates in advanced economies, and possible slump in oil prices.

While elevated naira yields and improved FX market efficiency are anticipated to attract capital inflows into Nigeria, we note that heightened geopolitical risks and high global interest rates present as tail risks.

Specifically, an escalation of the aforementioned global risks could trigger capital flight and intensify naira volatility. In this instance, we believe the naira could depreciate beyond our baseline forecast for 2025 (NGN1,775.00/USD), breaching the NGN2,000.00/USD threshold, as the CBN’s net FX reserves may be insufficient to temper significant volatility.

Such a sharp depreciation would amplify inflationary pressures, driving up import and energy costs, as naira depreciation could offset the impact of a decline in oil prices. In this scenario, we project an average inflation rate of 34.98% for 2025FY (2009 base year), compared to our baseline estimate of 32.45% (2009 base year).

Additionally, if oil prices fall significantly below our baseline estimate of USD76.00/barrel, it could reduce oil receipts to both the FX reserves and the federal government’s oil revenue.

In a worst-case scenario, where oil prices drop to USD65.00/barrel, with an estimated crude oil production of 1.42 million barrels per day (excluding condensates), and factoring in NNPC’s share of the oil JV and other encumbrances, inflows from crude oil receipts to the FX reserves could fall short of our baseline estimate of USD289.00 million and settle at USD240.83 million.

Furthermore, the federal government expects 56.3% of its total revenue (NGN34.82 trillion) to come from oil-related sources based on the 2025FY budget.

With an oil price assumption of USD65.00 per barrel and an average naira estimate of NGN1,775.00/USD, oil revenue may underperform, reaching only 69.0% of the target (NGN13.53 trillion vs Budget: NGN19.60 trillion).

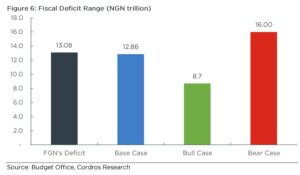

Assuming a budget implementation rate of 86.1% (NGN41.23 trillion vs budgeted NGN47.9 trillion), the fiscal deficit could rise to NGN16.00 trillion (Budget: NGN13.08 trillion), surpassing our baseline estimate of NGN12.86 trillion. This would likely result in higher government borrowing from the debt market, increasing the medium-term debt burden.-Analysis is written by Cordros Research and made available to theG&BJournal

X-@theGBJournal|Facebook-the Government and Business Journal|email:gbj@govbusinessjournal.com|govandbusinessj@gmail.com