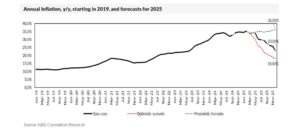

…But it is unlikely to make the year-on-year inflation measure worse after September 2025, and so we may see a significant decline in inflation during the fourth quarter.

…Our base case (we have assigned it a 65% probability) for inflation in 2025 is that it will continue to rise during the first part of the year, moderate mid-year and then fall, with a sharp fall in Q4 2025

…Inflation has created manifold problems for Nigeria over the past five years, doubling from 16.77% year-on-year in November 2018 to 34.60% y/y in November 2024

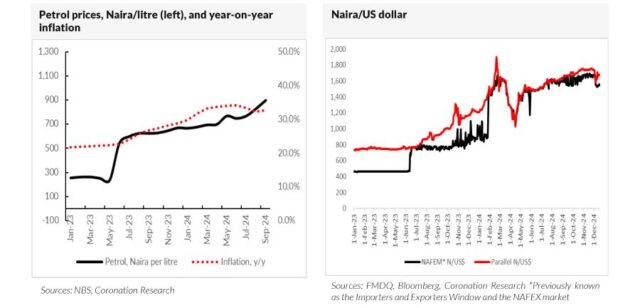

WED DEC 25 2024-theGBJournal| It has been a bad year for inflation with the measure rising from 29.90% year-on-year in January to 34.60% year-on-year for November.

Yet within the bad news is the potential for good news. We doubt fuel prices can rise much more, and we believe that currency depreciation will pose much less of threat in 2025 than it has done this year. ”All in all, we believe inflation can fall next year,” says analysts at Coronation Research.

Inflation has created manifold problems for Nigeria over the past five years, doubling from 16.77% year-on-year in November 2018 to 34.60% y/y in November 2024.

There are several causes of inflation. Some of them are difficult to quantify, such as insecurity that raises the costs of transporting goods along Nigeria’s highways.

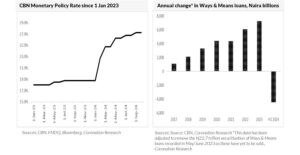

Others can be quantified, notably rises in fuel prices and the creation of money through unfunded loans to the Federal Government by the CBN.

Unfunded loans, that swell the amount of money in the economy without a corresponding rise in the volume of products and services, can be contrasted with funded loans such as T-bill issues, FGN bond issues and bank loans.

The CBN has a remit to reduce inflation. It does not have the means to improve security along Nigeria’s highways, nor can it influence the price of fuel, which is largely a function of subsidy withdrawal.

It can, however, exert control over the supply of money into the economy by changing interest rates, imposing a cash reserve requirement (CRR) on banks (currently 50% for deposit money banks), and by reversing (ie funding) the flow of its unfunded loans (socall ways and means loans) to the Federal Government.

In an economy such as Nigeria’s, which can be characterised as having a low level of monetisation (for example, most households do not hold mortgages, most small and medium-sized entreprises are financed with savings rather than with debt) it remains to be seen whether monetary controls can decisively break inflation.

But these are the means at the disposal of the CBN, and we believe they will have a positive effects on inflation (ie they will contribute to its decline) in 2025.

Fuel prices will play an important role in inflation in 2025. Fuel prices rose rapidly in 2024 as government subsidies were withdrawn. The bad news is that rises in fuel prices themselves feed through into the prices of almost any product or service one can think of, at least all those involving energy and transportation.

The good news is that, with a total withdrawal of fuel prices in effect as of September 2024, there is not much – short of a significant rally in crude oil prices, or another significant devaluation in the Naira – that can make them

rise again in 2025.

Of course, the rise in fuel prices in September 2024 will put pressure on year-on-year inflation throughout the first nine months of 2025.

But it is unlikely to make the year-on-year inflation measure worse after September 2025, and so we may see a significant decline in inflation during the fourth quarter.

The currency and inflation

The Naira/US dollar exchange rate will also be key to inflation in 2025. The relationship between inflation and the exchange rate works both ways.

Over long periods of time Naira inflation erodes the value of the Naira, and the Naira/US dollar exchange rate has to adjust for this (otherwise the Naira would be over-valued relative to the US dollar; Nigerian goods and services would be expensive in US dollarterms).

In the short-term Naira devaluation contributes to inflation. The prices of imported goods reflect their cost in US dollars, although imports are not a major component of the economy, so their impact is limited.

The CBN, like many a central bank, therefore, has an anti-inflationary tool at its disposal if it is able to influence the exchange rate. Stabliising or even

strengthening the Naira versus the US dollar has the potential to reverse the imported element of inflation.

The good news is that recent months have seen a levelling off in the Naira/US dollar exchange rate. This has happened as foreign portfolio investment (FPI) has increased, with the CBN recording inflows of US$2.3bn during October and November.

The foreign exchange reserves of the CBN are set to gain from the Federal Government of Nigeria’s issue of US$2.2bn of Eurobonds in early December. The ability of the CBN to supply US dollars to the official NAFEM foreign exchange market is set to increase and, we believe, could moderate the decline of the Naira against the US dollar to around 15% depreciation over the year. It is even possible that the Naira could appreciate.

Ways and means loans

In his National Broadcast on Independence Day, 1 October, President Bola Ahmed Tinubu spoke about the repayment of ‘ways and means debt’ as a key milestone.

Ways and means loans are not so much an obscure financial engineering technique as a problem the reform-minded administration wants to fix.

Ways and means loans were initially designed to tide over shortterm liquidity constraints experienced by the Federal Government, but during the six years 2018-23 swelled to become a mainstay of budget financing.

The problem is that ways and means loans are unfunded (pension funds, mutual funds and banks do not buy them in the same way in which they buy T-bills and FGN bonds) and are created by the CBN.

They represent a net addition of money supply, and if the economy does not produce commensurately more goods and services then inflation is the result.

In the first half of 2024 the issuance of ways and means loans went into reverse, with some N4.5 trillion removed.

If this policy is continued (up-to-date information for the months after June 2024 is not currently available) then H2 2024 will see more ways and means loans removed. Continuation of the policy would, most importantly, prevent further expansion of money supply from this source.

Scenarios for 2025

Our view is that the combination of these three factors have the potential to reduce inflation in 2025. This is not to say that inflation will not increase during the first quarter of the year, due to year-on-year increase in fuel prices and currency depreciation.

But we think that the continuing efforts of the CBN will bear fruit, particularly later in the year when the year-on-year comparison in terms of fuel prices and currency is likely to reduce.

We have set out three scenarios for inflation in 2025.

Our base case (we have assigned it a 65% probability) for inflation in 2025 is that it will continue to rise during the first part of the year, moderate mid-year and then fall, with a sharp fall in Q4 2025. In this scenario we see inflation falling to 23.00% y/y by year-end (December).

This scenario is consistent with the CBN being able to limit Naira/US dollar depreciation to under 15% during 2025.

Our optimistic scenario (25% probability) is for inflation to fall to 18.0% y/y by year-end 2025. This would be consistent with the CBN succeeding with a robust defense of the Naira versus the US dollar, with the Naira actually appreciating over the course of the year to some N1,230/US$ by year-end.

Our pessimistic scenario (10% probability) sees a complete reversal of the current policies of the CBN. This would mean very steep cuts in interest rates (in the supposed interests of economic growth) and a weakening in the currency by some 42%.-Special report is provided by Coronation Research

X-@theGBJournal|Facebook-the Government and Business Journal|email:gbj@govbusinessjournal.com|govandbusinessj@gmail.com