News of Nigeria’s finances gets better. The currency appreciated from N1,638.68/US$ to N1,552.50/US$1 last week, doubtless helped by the new Electronic Foreign Exchange Matching System (EFEMS) which, according to traders, increased liquidity.

October and November each saw the arrival of over US$1.0bn in Foreign Portfolio Investment. Last week the Federal Government raised US$2.2bn in Eurobonds. Was this a good Eurobond deal for Nigeria? We believe so.

TUE DEC 10 2024-theGBJournal| A week ago the Federal Government raised US$2.2bn in two Eurobond issues, returning to the market after a long absence. Were these good deals for Nigeria? We think so.

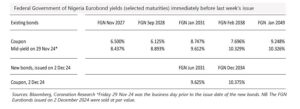

The coupons offered were much more generous than those of earlier FGN Eurobonds, but there are good reasons for this.

A Eurobond issue by the Federal Government of Nigeria has been on the cards all year. Back in August, we opined that conditions for an issue had been almost good enough back in March, but had since deteriorated (yields had risen), and wrote: “This does not rule out the FGN making a Eurobond issue this year, but it suggests that a renewed period of price appreciation would help the process along.”

Prices did rise and between 12 August and 29 November (the trading day before last week’s issue) the average yield of the six FGN Eurobonds featured the two charts above fell by 0.8 of a percentage point.

This brought the mix of possible coupons within the range acceptable to Nigeria’s Debt Management Office (DMO).

The market for new sovereign Eurobonds is fickle. The managers of these issues have to time the mood of the market carefully. There are brief periods, or ‘windows’ when conditions are right. The end of November was one such period.

Nigeria had received a very good scorecard from the World Bank in the October issue of its bi-annual Nigeria Development Update, and international investors were doubtless impressed.

The NDU gave Nigeria high marks for monetary and foreign exchange policy, and for the removal of fuel subsidy.

Market comment on the day suggested that the DMO was generous with its coupons. By contrast, we believe that the pricing was fair. It is clear that the coupons allocated on 2 December were very close the mid-price yields at the end of the previous trading day, Friday 29 November.

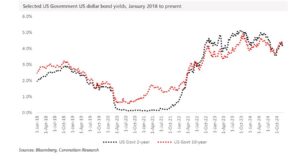

This leaves the question of why the coupons of the new Eurobonds are higher than those of existing Eurobonds. The answer is that all US dollar Eurobonds are priced relative to US Government bond yields, and these used to be much lower than they are today.

For example, when the existing FGN Jan 2031 bond was priced on 14 Nov 2018 with a coupon of 8.747%, the 10-year US Government yield was 3.06%, giving the FGN a spread of 5.68 percentage points over the US Government bond.

When the FGN Jun 2031 bond was priced on 2 Dec 2024 with a coupon of 9.625%, the US Government 10-year yield was 4.17%, giving a spread of 5.46 percentage points, a very similar spread to that of the earlier issue.

(We have used the US Government 10-year yield as a convenient benchmark. Those pricing these bonds last week would have also looked at the 6.5-year US Government maturity to assess their pricing.)

The CBN and the Naira

These bond issues strengthen the hand of the CBN when it comes to managing the foreign exchange market, in our view. Recent months (October and November) have seen over US$2.0bn arrive in Foreign Portfolio Investment (FPI), a vote of confidence in the Naira and Naira-denominated securities.

These inflows, plus the US$2.2bn raised in Eurobonds last week, suggest that the both the gross foreign exchange reserves and the net foreign assets of the CBN will rise soon.

We cannot say whether or not the CBN will decide to use some of this money to supply extra US dollars (over and above what it has been supplying so far this year) to the NAFEM market, but it is fair to say that it increases the CBN’s potential to influence the market, something that is likely to boost confidence in the Naira.-Written by Coronation Research and made available to theG&BJournal

X-@theGBJournal|Facebook-the Government and Business Journal|email:gbj@govbusinessjournal.com|govandbusinessj@gmail.com