MON NOV 18 2024-theGBJournal| Naira volatility continues to complicate Nigeria’s economic landscape, adding uncertainty and challenges to the nation’s financial stability.

Since the beginning of the year, the Central Bank of Nigeria (CBN) has adopted a hawkish stance, raising interest rates by 850 basis points in an effort to tackle inflation.

Given the ongoing inflationary pressures and the likelihood of continued exchange rate instability, another rate hike of 50 basis points but retains CRR levels is anticipated at the CBN’s next meeting.

This measure is intended to combat inflation by increasing borrowing costs, thus reducing demand, however slowing economic activity.

The CBN faces growing pressure to implement further tightening measures to address the persistent inflationary trend. Balancing price stability with economic growth will remain a complex challenge for policymakers.

Also, additional tightening, such as increasing the Cash Reserve Ratio (CRR), could further limit liquidity in the banking sector, restricting lending and investment. This would have a broader impact on economic activity, potentially exacerbating the challenges faced by businesses and consumers alike.

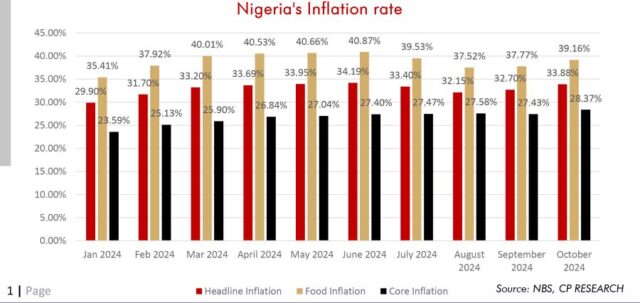

Meanwhile, October’s inflation data published last week by the National Bureau of Statistics (NBS) highlights a concerning escalation in Nigeria’s economic environment.

Headline inflation rose to 33.88%, up from 32.70% in September, reflecting a significant increase.

This marks the second consecutive month of rising annual inflation, indicating that Nigeria’s inflationary challenges remain unresolved. Despite a temporary slowdown in previous months, inflationary pressures have resumed, further straining consumer budgets and the broader economy.

food inflation, a major contributor to overall inflation, surged to 39.16% in October, surpassing the previous month’s rate.

The persistent impacts of September’s floods in northern Nigeria, alongside rising transportation costs, are significant factors behind the surge in food prices.

These challenges in the agricultural sector, including supply chain disruptions, adverse weather conditions, and rising input costs, have exacerbated food inflation, putting further strain on household budgets.

With the festive season approaching, food prices are expected to surge, putting additional strain on household budgets and likely leading to more restrained celebrations.

Inflation continues to erode consumers’ purchasing power, and the delayed implementation of import waivers on certain food categories has intensified price pressures. We foresee a rise in food inflation in the coming months, fuelled by higher fuel prices that drive up transportation costs for goods.

Exchange rate fluctuations further exacerbate this issue, particularly affecting the prices of imported food items. Even when the food waiver policy is implemented, ongoing exchange rate volatility is likely to continue impacting food prices, presenting a challenging outlook for consumers and the economy as a whole.

While headline and food inflation saw marked increases, core inflation—which excludes volatile food and energy prices—moderated slightly to 28.37%. This suggests that underlying inflationary pressures may be easing, albeit slowly.

Nonetheless, the persistence of elevated core inflation signals widespread price increases across the economy, continuing to fuel inflationary concerns.

Quick update on the inflation trends for October:

Headline CPI (YoY): In October, the Headline CPI (Year-over-Year) recorded 33.88% from 32.70% in September, reflecting an increase of 1.18%. On a year-over-year basis, it increased by 6.55% from 27.33% in October 2023.

Headline CPI (MoM): On a month-to-month basis, the inflation rate in October 2024 was 2.64% is 0.12% higher than the 2.52% recorded in September 2024.

Food Inflation (YoY): Food inflation, a significant driver of overall inflation increased to 39.1% in October, up from 37.77% in September.

Food Inflation (MoM): On a month-on-month, the food inflation rate was 2.94% in October 2024, reflecting a 0.30% increase from the 2.64% recorded in September 2024.

Core CPI (YoY): Core inflation, which excludes volatile agricultural produce and energy prices, stood at 28.37% in October, down from 27.43% in September 2024.

Core CPI (MoM): Month-on-month, the Core Inflation rate increased to 2.14% in October 2024 from 2.10% in September 2024, marking a 0.04 %-With Comercio Partners Research

X-@theGBJournal|Facebook-the Government and Business Journal|email:gbj@govbusinessjournal.com|govandbusinessj@gmail.com