…We think that the incoming administration wants oil prices to stay low. We believe that some of its policies will effectively prevent a sharp decline in US bond rates in 2025.

…Neither of these are necessarily good for Nigeria, though President

…Trump’s attitude to Bitcoin may encourage some Nigerian savers.

WED NOV 13 2024-theGBJournal| Nigeria’s economy has a few key relationships with the United States and with global markets. The most obvious of these is the oil price; another is the yield of US government bonds.

The latter influences global investors’ appetite for risk and therefore their appetite for emerging market bonds.

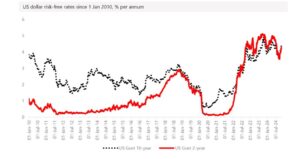

Starting with the yield of US government bonds, it is important to look at a long-term chart. Today’s yields of both 2-year and 10-year bonds are well above 4.00% pa.

These yields, given inflation expectations in the US of some 2.6% pa in a year’s time, make risk-free US government bonds a store of value.

It was when US 2-year bond yields were below 1.0% pa that American and other US dollar-based investors went hunting for yield in emerging markets.

Those were the days of the so-called carry trade, borrowing in cheap US dollars to finance investments in risky emerging market bonds

The carry trade meant that foreign portfolio investment (FPI) flowed from US dollars into Nigerian T-bill and FGN Naira-denominated bonds, as well as the Open Market Operation (OMO) bills of the Central Bank of Nigeria (CBN).

This was handy money when it came to building up foreign exchange reserves, even if the money had to be paid back quickly (usually within a year).

Even when US Government bond rates were a little over 2.0%, in 2018 and 2019, the dollars flowed into Nigerian government securities.

The rise of inflation in the US, and the raising of US policy rates to combat it, has made things more difficult. US bond yields in excess of 4.0% do not help the carry trade. So the question is: “When will US bond rates return to 1.0%, or less?”

The answer is: “Not soon.” The incoming administration of President Donald Trump promises two policies that could put upward pressure on US inflation. The first is its tariffs policy that would simply raise the cost of a range of imported goods in America. The second is the policy of deporting illegal immigrants.

This may have the effect of removing the cheapest labour available to American businesses. In addition, the new administration intends to cut corporate taxes, which implies that it will need to borrow more money from American bond market

These factors add up to upward pressure on inflation and on US bond yields. The chances of a sharp decline – say, to 2.0% pa or less – in US bond yields in 2025 appear to be slim.

This is not to say that some foreign investors will not make the carry trade in order to buy Nigerian securities in 2025. With last week’s Nigerian 1-year T-bills offered at a juicy yield of some 29.9% at auction, we may well see foreign investors sell US dollars in order to buy these and OMO bills.

It is just that the volumes would probably be much bigger if US rates were lower.

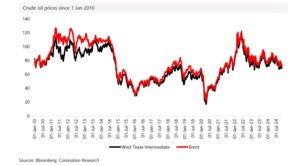

Next, consider President Trump’s approach to oil. In recent decades the US has emerged as the world’s largest oil producer, with output of some 13.3 million barrels per day (mbpd).

The incoming administration wants production to rise and it intends to pass legislation opening up new areas for exploitation. It desires oil prices, and US gasoline prices, to fall, but the question is how far.

Low gasoline prices are good for American consumers (and for US inflation) but they cannot fall to levels at which US oil producers are unprofitable.

And it is very difficult to establish the average, or median, cost of oil production in the US given the wide variety of geological sources (from offshore to shale).

Our sense is that a West Texas Intermediate price of US$65.00/bbl, with the price of Brent at perhaps US$68.00/bbl, is what is required to keep the US oil industry profitable enough to attract new investment.

So, while we believe that the incoming Trump administration will prefer not to have oil prices above US$80.00/bbl (which would be inflationary), it does not want a sharp decline from today’s levels (WTI trades at US$68.44/bbl) either.

In short, we are looking at a gradual, rather than a swift, fall in US bond rates going forward, and a quite low (relative to averages year-to-date of some US$80.96/bbl) oil prices.

Perhaps the bright spot is for those Nigerians with savings in Bitcoin. The incoming Trump administration has announced its support for crypto currencies and the price of Bitcoin has surged past US$85,000.-Special Report is provided by Coronation Research

X-@theGBJournal|Facebook-the Government and Business Journal|email:gbj@govbusinessjournal.com|govandbusinessj@gmail.com