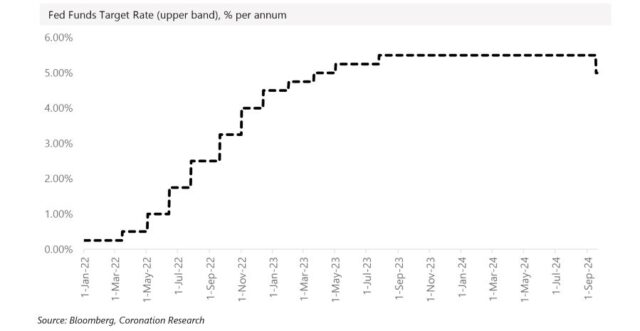

…Last week the US Federal Reserve cut the upper level of its target funds rate by half a percentage point, from 5.5% to 5.0%. What does this mean for US markets, emerging markets, and Nigeria?

…Emerging markets like Nigeria offer investors superior yields to those in developed markets, and investors may come looking for them again.

TUE SEPT 24 2024-theGBJournal|To understand what might happen, it helps to go back almost three years, to the beginning of 2022. Then the spectre of US dollar inflation appeared and the Federal Reserve began putting up its policy rate.

The US equity markets did not like this because rising rates implied a threat to US company profits and also meant that some funds that borrow money to play the equity markets would face challenges.

The Nasdaq Composite Index fell by 33% and the S&P 500 Index fell by 19% in 2022. Then, in 2023, as companies and markets became accustomed to elevated rates (and company profits, by and large, advanced) the Nasdaq gained 43% and the S&P 500 gained 24%.

As investors in US equity markets have witnessed the US Federal Reserve overpowering inflation this year, they have anticipated cuts in its policy rate, and both the Nasdaq and the S&P 500 have advanced again. Both are up 19.6% year-to-date.

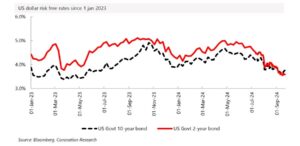

So far, so good: US policy rates are coming down; US government bond yields are also falling; US equity markets are rising. Yet the US equity market returns over the past two months look a little flat, with the Nasdaq up just 1.2% (although the S&P 500 is up 3.6%).

To some extent, this is normal equity market behaviour, because equity markets typically buy in anticipation of good news and some participants sell once the good news materialises.

At the same time, some economists and market strategists are predicting a recession in the US. Seen in this light, the cut in the Federal Funds rates is not so much a triumphant response to the fall in US inflation as a pre-emptive attempt to stave off economic reversal.

This is the pessimistic interpretation of exactly the same news flow that has been driving US equity markets up this year. One could call it a ‘change in narrative’.

The pessimists point out to the fact that short-dated US government bond yields are above long-dated yields, and that this is a harbinger of a recession. It has been on several occasions, which is not the same thing as saying that it necessarily predicts a recession.

And our task is not to predict whether the US will have a recession or not, but to describe what might happen if US equity returns cool off towards the end of this

year and on into 2025.

In our view, the very high returns of US equity markets over the yeras has focused the attention of High Net Worth Individuals (HNI) on these markets, rather than emerging markets like Nigeria.

It is understandable: over the past 10 years the Nasdaq Composite Index has delivered a return of 293% (a compound annual growth rate 14%) and the S&P 500 has delivered 185% (a CAGR of 11%).

But, on the assumption that these returns cannot continue indefinitely, one would expect HNIs to broaden their horizons in future.

A recession – indeed, even a slowdown in the rate of economic growth – in the US would encourage the US Federal Reserve to make further and rapid cuts in its policy rate, and this would likely drive US government bond yields still lower.

An environment of low US rates would encourage investors to look at emerging markets again. The MSCI Emerging Markets equity index is up 8.1% already this year. Emerging markets like Nigeria offer investors superior yields to those in developed markets, and investors may come looking for them again.

X-@theGBJournal|Facebook-the Government and Business Journal|email:gbj@govbusinessjournal.com|govandbusinessj@gmail.com