…The equity market is being asked to raise in the region of N3.0 trillion (once upcoming deals are announced) in capital increases for the banks. It sounds like a tall order, but we think the money will be raised

TUE JULY 30 2024-theGBJournal|Consider the lot of an investor in listed Nigerian bank shares.

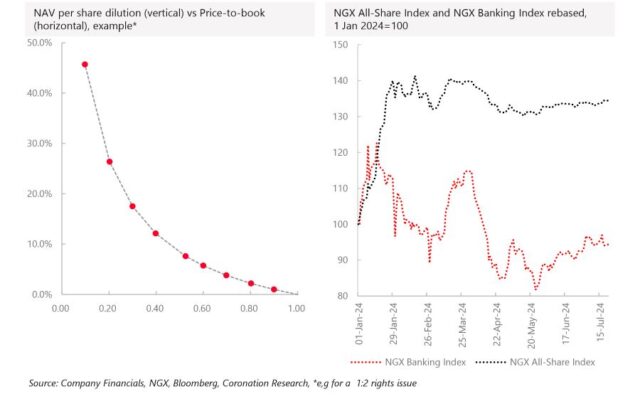

2023 was a glorious year, with the NGX Banking Index gaining 108.7%, compared with the NGX All-Share Index’s return of 45.9%. 2024 has not been so kind, with the NGX Banking Index down by 7.67% year-to-date compared with a rise in the NGX All-Share Index of 31.3%.

If investors were hoping for 2024 to be another year of stellar performance for banks, then the Central Bank of Nigeria’s circular of 28 March 2024 put paid to that.

The circular requires a high level of recapitalisation of banks, not based on their total shareholder’s funds but on their initial paid-up capital.

At first, many market participants questioned the logic of excluding retained earnings in a calculation of Total Shareholders’ Funds, but these arguments had to be put aside as banks accepted the CBN’s requirement.

Our initial calculation was that banks, in aggregate (and unless they merged to form larger entities), were being asked to raise over N3.0 trillion in fresh equity. (The combined market capitalization of the banks on 28 March was N8.1 trillions.) Therefore, the big question was, and remains: “Can the banks raise this much money?”

We believe they can. One good reason to think this lies in the arithmetic of rights issues. The market values most Nigerian banks at a discount to their published book values.

This is a problem for existing shareholders when it comes to rights issues, because more shares have to be sold in order to raise a given sum of money than would be the case if the shares traded at book value (a price-to-book, or P/BV, of 1.0x). This is known as the dilutive effect, and it is the reason why bank stocks retreated after the announcement on the 28 March.

The flip side of this is that what is dilutive for existing shareholders is accretive (value-adding) for incoming shareholders.

If a bank’s rights issue price values it at 0.50x book value (P/BV=0.5x) then an incoming shareholder buys twice as much book value as they would if the valuation was 1.00x book value. This provides new shareholders a significant incentive to buy new shares.

This leaves open the question of the sheer amount of money to be raised (there is a compelling logic to buying new shares, but the money must still be found). Take a sum like N3.0 trillion, which is just shy of US$2.0bn.

It may sound like a lot, but pales into comparison with other metrics such as the value of prime real estate in central Lagos (surely, many times higher), and the market capitalisation of the companies listed on the NGX Exchange at some N55.91 trillion.

While we are not saying that raising money is easy, the sum to be raised does not appear to be out of proportion what can be raised.-Analysis is written by Coronation Research.

X-@theGBJournal|Facebook-the Government and Business Journal|email:gbj@govbusinessjournal.com|govandbusinessj@gmail.com