…What financial impact will this windfall tax have on the banks, and on the government’s finances? To answer these we have assessed the six large banks under our coverage

…Our examination of the reported and audited group-level foreign exchange gains of the six financial holding companies and banks under our coverage, for 2023, suggests that this may prove difficult

…Most of the 2023 gains, in our view, arose from booking US dollar loans at the prevailing Naira/US dollar exchange rate, creating paper profits in Naira. (The Naira fell from N460.8/US$1 to N911.7/US$1 last year.)

TUE JULY 23 2024-theGBJournal| Last week’s announcement that banks may be asked to pay a 50% tax on their windfall currency gains in 2023 caused consternation.

The NGX Exchanges’ sub-index of banks fell by 3.0% over the two days following the announcement which came in the middle a round of capital raising by listed banks and their holding companies.

What financial impact will this windfall tax have on the banks, and on the government’s finances? To answer these we have assessed the six large banks under our coverage.

We can begin with the question of whether the proposal refers to realised or unrealised foreign exchanges gains (or losses). If they are realised then there is likely to be cash with which to pay tax: but if they are unrealised, as most of them are, then the cash is not so ready.

Most of the 2023 gains, in our view, arose from booking US dollar loans at the prevailing Naira/US dollar exchange rate, creating paper profits in Naira. (The Naira fell from N460.8/US$1 to N911.7/US$1 last year.)

Another question is how these gains can be measured fairly across different financial holding companies and banks.

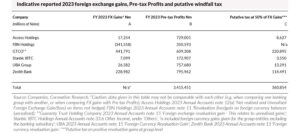

Our examination of the reported and audited group-level foreign exchange gains of the six financial holding companies and banks under our coverage, for 2023, suggests that this may prove difficult.

Accounting is more of an art than a science. As the long note to our table suggests, different companies may be talking about slightly different things when they report foreign exchange gains.

It falls to the regulator, the Central Bank of Nigeria, to determine what the 2023 foreign exchange gains were for each bank. Yet note that this is a government, not a CBN, initiative.

Given that the CBN has a hard-and-fast method of assessing foreign exchange gains in each financial holding company and bank, then there are more questions.

Since part of these foreign exchange gains made their way into Pre-tax Profits in 2023, then will the tax already paid on this portion be offset against the proposed new tax? And is a tax on a past-year’s performance enforceable? We do not have answers to these.

Looking at the data prompts more questions. Are we talking about bank holding companies or their banking subsidiaries? It makes a difference. For 2023 FBN Holdings reported a N341,558 million foreign exchange loss at the group level: but a N787 million gain at the bank level.

Access Holdings reported a N17,254 million foreign exchange gain at the group level: but a N145,845 million loss at the bank level.

Even leaving this Group versus Company issue aside, the data is so difficult to process that we discourage our readers from making a direct comparison between columns A and B in the table above. (I.e. please do not infer that x% (A/B) of

a company’s Pre-Tax Profits came from foreign exchange gains: accounts are more complicated than that; think, for example, of the effects of using derivatives to hedge foreign currency positions and how these are accounted for.)

Finally comes the question as to whether we are talking about a truly large sum of money.

True, and given all the caveats listed above, our estimate of the total putative tax that could be paid by the six banks under our coverage may not be close to the mark; but even as an approximate figure, N360.8 billion does not appear to be a lot in the context of the requirements of a government that recently announced a N6.1 trillion supplementary budget.-Analysis is written and provided by Coronation Research

X-@theGBJournal|Facebook-the Government and Business Journal|email:gbj@govbusinessjournal.com|govandbusinessj@gmail.com