…The total trading volume increased by 121.2% to 935.15 million units, valued at NGN11.84 billion, and exchanged in 8,160 deals.

…FIDELITYBK was the most traded stock by volume and value at 698.21 million units and NGN7.27 billion, respectively.

WED JULY 10 2024-theGBJournal| The Nigerian equities market traded with mixed sentiments on Wednesday, as losses in ZENITHBANK (-1.2%) and GTCO (-0.9%) offset the gains in DANSUGAR (+2.8%) and TRANSCORP (+2.5%).

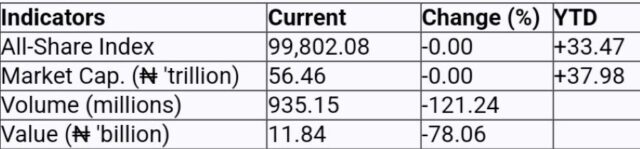

As a result, the All-Share index closed flat at 99,802.08 points. Accordingly, the Month-to-Date and Year-to-Date returns settled at -0.3% and +33.5%, respectively.

The total trading volume increased Wednesday by 121.2% to 935.15 million units, valued at NGN11.84 billion, and exchanged in 8,160 deals.

FIDELITYBK was the most traded stock by volume and value at 698.21 million units and NGN7.27 billion, respectively.

On sectoral performance, the Banking (-0.4%) and Insurance (-0.2%) indices settled lower, while the Oil and Gas (+0.4%) and Consumer Goods (+0.3%) indices posted gains. The Industrial Goods index closed flat.

As measured by market breadth, market sentiment was positive (1.2x), as 25 tickers gained relative to 21 losers. ABCTRANS (+10.0%) and ETERNA (+9.9%) topped the gainers’ list, while THOMASWY (-10.0%) and DAARCOMM (-8.8%) recorded the highest losses of the day.

The naira depreciated by 1.9% to NGN1,561.98/USD in the Nigerian Autonomous Foreign Exchange Market (NAFEM).

The exchange rate at the NAFEM window fell by 0.29% last week to close at N1,509.67/US$1, after touching a week low of N1,520.24/US$1.

This brought the year-to-date depreciation of the Naira to 39.91%.

The parallel market rate closed unchanged from the previous week at N1,525.00/US$1, although it started the week at N1,510.00/US$1.

Consequently, the gap between the official and street markets narrowed to 1.02% (1.31% the previous week).

Furthermore, the CBN’s published gross foreign exchange reserve added 1.36% or US$465.21mn to close the week at US$34.66bn.

X-@theGBJournal|Facebook-the Government and Business Journal|email:gbj@govbusinessjournal.com|govandbusinessj@gmail.com