…During these four months pension funds increased their total assets by 12.6% to N19.5 trillion (US$13.5bn at the NAFEM rate last Friday)

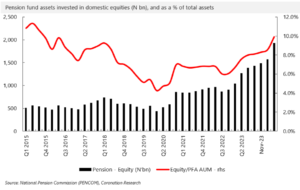

TUE, MAR 26 2024-theGBJournal|During 2023 Nigeria’s enormous pension funds warmed to equities, raising the equity proportion of their total assets under management (AUM) from 6.1% to 8.6%. Their equity holdings rose by 73.0%. Does this mean that they were buying equities in order to re-balance their clients’ portfolios?

And, judging by their recent activity, are they going to continue buying equities in 2024? In this article we provide answers to both questions.

First, take that 73.0% rise in their equity holdings, from N908.0bn to N1,571.2bn, last year. The NGX All-Share Index rose by 45.9% last year, with the total return (with gross dividends reinvested) rising by 53.0%. So, it seems that they must have been making some net purchases of equities during 2023.

We think that they made net purchases around N180.0bn of equities last year, though they would have bought somewhat less than this had they been overweight bank stocks at the beginning of the year (the sub-index of bank stocks rose by 141.7% last year).

So much for the full-year 2023. What of their recent activity? Here we examine the past four months, from the end of September to the end of January (which is the last month for which we have data).

During these four months pension funds increased their total assets by 12.6% to N19.5 trillion (US$13.5bn at the NAFEM rate last Friday), and their holdings of equities rose by 39.3% to N1.9 trillion. So the percentage of their funds invested in equities rose from 8.0% to 9.9%.

But, in all probability, this does not mean that they were net buyers of equities. The NGX All-Share Index rose by 52.4% over the same period, so either they were net sellers of equities, or their equity holdings underperformed the market.

How could they have underperformed the market? We believe that many pension funds are unwilling to invest more that a certain percentage of their equity sub-portfolios – say 10% – in a single stock. That causes problems in an index with a few very large weights (for example, today Dangote Cement accounts for 21.0% of the index, Airtel Africa 14.9% and BUA Foods 12.29%), especially when one of them rises a lot (Dangote Cement is up 114.7% so far this year, for example).

Our sense is that pension funds’ enthusiasm for equities is cooling off. And why wouldn’t it? Market interest rates are rising and it is possible that their portfolios of Nigerian Treasury Bills (T-bills) will yield more than double what they yielded last year. While fixed-income yields fall well short of the rate of inflation, it is possible that pension fund managers today are content with what T-bills and FGN bonds have to offer.

Report is written by Coronation Research and made available to theG&BJournal

X-@theGBJournal|Facebook-the Government and Business Journal|email:gbj@govbusinessjournal.com|govandbusinessj@gmail.com