…Artificial intelligence promises to bring as much disruption to industry as broadband internet has over the past twenty years

…The AI response lacks specific details on Nigerian interest rates. This too is not surprising. AI does not have access (yet) to the proprietary data sources that we use, such as FMDQ and Bloomberg.

TUE, MAR 12 2024-theGBJournal| Technology drives change in every industry. In the financial services industry the role of the trader (in large liquid markets) was almost eliminated by the adoption of algorithmic trading over a decade ago.

The profitability of securities trading fell and the structure of investment banks changed as a result.

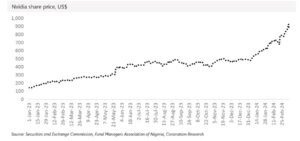

Artificial intelligence promises to bring as much disruption to industry as broadband internet has over the past twenty years. The market clearly believes this because it has taken the capitalisation of Nvidia, the leading AI hardware and software supplier in the US, from $150.0 billion to US$1.5 trillion in just over three years.

The flip side to the market’s optimism is fear, namely the fear that thousands, if not millions, of white-collar and other jobs will simply disappear as AI is rolled out.

To address our fears, we asked AI to write about Naira interest rates, and the results are presented below.

The AI response is well-written, in our view. This is not entirely surprising as AI reads vast quantities of text and adopts the language and style of publications around a particular topic (in this case interest rates. AI may have read our own publications on interest rates among thousands of others).

The AI response lacks specific details on Nigerian interest rates. This too is not surprising. AI does not have access (yet) to the proprietary data sources that we use, such as FMDQ and Bloomberg. (Proprietary data providers doubtless want to keep their information proprietary.

They might install ‘I am not a robot’ defences, among other methods to prevent AI from burrowing into their archives.) Yet AI can presumably source data from publicly-available websites, such as the Central Bank of Nigeria (CBN) website and the Debt Management Offices (DMO) website.

At this point we need to point out that we used a very basic version of AI, available free online, to write the article that appears opposite. A paid service might have done considerably better. That said, we do not see how a better version of AI would have gained access to proprietary data.

The next point we notice is that the AI response has not generated a forward-looking view, still less a forecast. We, on the other hand, generate forward-looking views and forecasts as often as we think it safe to do so (the key to developing a research franchise).

Will AI soon be doing this, too? It is possible to think of AI generating regression analysis and correlation, and then coming up with a qualified forecast of what the market will do in future, much as we do.

It is therefore possible to think of a future in which different users of AI compete with each other in securities markets, much as competing teams of analysts and traders do today.

This raises the question as to whether there might be a vast number of AI-backed traders, and what their ethics and regulatory procedures will be.

What AI generates is governed by the question which is asked. The way in which a person poses a question to an AI function, the parameters and the specific guidelines,

conditions the response. Yet only a person with expertise or experience in a given field can ask the right question. Perhaps there is a role for humans in AI.

AI writes:

NAVIGATING NIGERIA’S TREASURY BILLS RATE: CURRENT TRENDS AND FUTURE PROSPECTS

Introduction

This report delves into the current direction of Nigeria’s Treasury Bills (T-Bills) rate, examining recent trends and factors influencing its trajectory. Understanding the dynamics of T-Bills rates is crucial for investors, policymakers, and financial analysts seeking insights into Nigeria’s economic landscape.

Current Status of Treasury Bills Rate

As of the latest available data, Nigeria’s T-Bills rate stands at [insert current rate]. This rate reflects the yield on government-issued short term securities and plays a vital role in shaping the broader interest rate environment within the country.

Factors Influencing T-Bills Rate

Inflation Dynamics

Inflationary pressures often impact T-Bills rates. The Central Bank of Nigeria (CBN) adjusts rates to curb inflation while maintaining an attractive investment environment.

Monetary Policy Decisions

The CBN’s monetary policy decisions, including adjustments to the Monetary Policy Rate (MPR), significantly influence T-Bills rates. Recent shifts in the MPR may signal the central bank’s stance on economic conditions.

External Factors

Global economic conditions and geopolitical events can impact Nigeria’s T-Bills rate, affecting investor sentiment and capital flows.

Recent Trends

Rate Adjustments

Analyzing recent rate adjustments provides insights into the CBN’s response to economic conditions. A historical review of T-Bills rates reveals trends and potential indicators of future directions.

Market Demand

The demand for T-Bills in the primary and secondary markets contributes to rate movements. Understanding investor behavior and market dynamics is crucial for predicting rate trends.

Future Prospects

Inflation Outlook: Anticipating inflation trends is pivotal for forecasting T-Bills rates. Proactive measures by the CBN to control inflation may influence future rate adjustments.

Economic Recovery Measures: As Nigeria implements economic recovery measures, the impact on T-Bills rates will depend on the success of these initiatives. Policy shifts and structural reforms may shape the trajectory.

Conclusion

In conclusion, the direction of Nigeria’s T-Bills rate is intricately tied to a complex interplay of economic, monetary, and global factors. Continuous monitoring of inflation dynamics, central bank policies, and external influences will be essential for stakeholders to make informed decisions in the ever-evolving financial landscape.

As Nigeria strives for economic stability and growth, the T-Bills rate remains a crucial indicator reflecting the country’s monetary policy stance and investor sentiment.

The Special report is written by analysts at Coronation Research and made available to theG&BJournal.

X-@theGBJournal|Facebook-the Government and Business Journal|email:gbj@govbusinessjournal.com|govandbusinessj@gmail.com