...Now that T-bills yields are, in effect, twice what they were in 2023 (on average), we expect subscriptions to Money Market funds to rise at a double-digitrate in 2024.

…The total assets under management (AUM) of Nigeria’s Money Market funds rose by a compound annual growth rate of 76% from 2012 to 2019

TUE, MAR 05 2024-theGBJournal| Nigeria’s fixed income returns have been transformed recently. 1-year T-bill rates that were seldom more than 10.0% per annum during 2023 have been trending at over 20.0% pa for the past few weeks.

What does this mean for ordinary savers? They are set to enjoy far better risk-free returns than at any time over the past four years. In late 2019 T-bill rates crashed and stayed low during the period 2020-2023.

Money Market funds were much less attractive than before, and investors put their savings to work in more risky markets, like equities.

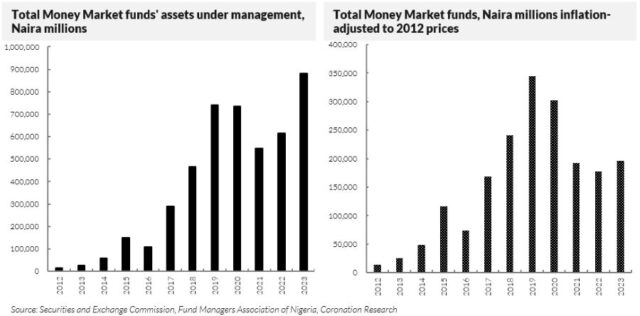

The total assets under management (AUM) of Nigeria’s Money Market funds rose by a compound annual growth rate of 76% from 2012 to 2019 (58% in inflation-adjusted terms) but only grew by 4% per year between the beginning of 2020 and the end of 2023 (falling by 13% per year in inflation-adjusted terms).

Now that T-bills yields are, in effect, twice what they were in 2023 (on average), we expect subscriptions to Money Market funds to rise at a double-digitrate in 2024.

A reasonable strategy for a saver who has had some exposure to the equity market this year might be to take profits from the equity market (which is up 32.1% year-to-date) and invest the proceeds either directly into T-bills, if possible, or into Money Market funds.

A point to bear in mind is that it will take some time for most Money Market funds to yield as much as T-bills. This is because Money Market funds still hold older fixed-income investments (e.g. T-bills bought a few months ago) that depress their average yields. Yet, these are likely to rise, benefitting both current and future holders of these funds.

And yields may get better than even recent T-bill auctions suggest. At an investor conference last Thursday, the Central Bank of Nigeria suggested that, in future auctions, rates could go even higher, and at last Friday’s auctions of the CBN’s OMO bills (which can be bought by banks and foreign investors) the 1-year yield was 27.39% pa, compared with 23.46% pa at recent T-bill auctions. There is to be a T-bill auction this week, so we shall see.

This is not to say that T-bills and Money Market mutual funds now beat inflation: they don’t. Inflation is running at 29.9% pa. But T-bills do, and Money Market funds soon will, offer returns that much higher than in recent years and much higher than most bank deposit accounts.

Even so, many investors are still likely to take a degree of risk to achieve yield enhancement, taking such instruments as private credit funds and public infrastructure funds.

And just as improvements in yields are likely to encourage subscriptions to Money Market funds (which account for 39.4% of the total AUM of the mutual fund industry), we also expect a rise in subscriptions for Naira-denominated Fixed Income funds, which typically hold FGN bonds (account for 12.85% of the industry).

All in all, we believe that 2024 will bring a reset in the attitudes of Nigerian investors, with a return to the mindset that prevailed before 2020 and a more positive approach to risk-free investments (T-bills, FGN bonds) and a realistic balance between these and the opportunities available in private credit portfolios, infrastructure funds

and equities. By Coronation Research (Weekly Update)

X-@theGBJournal|Facebook-the Government and Business Journal|email:gbj@govbusinessjournal.com|govandbusinessj@gmail.com