…As markets resume trading in 2024 the biggest issue is foreign exchange. Are things going to get better or worse? Sometimes, we believe, and when all the evidence points to trouble, it pays to be optimistic.

TUE, JAN 09 2024-theGBJournal|Newspaper reports back in October stated that the Finance Ministry plans to borrow US$10.0 billion with forward sales of oil and gas from the government-owned NNPC Limited (US$3.0 billion) and its partly-owned Nigeria LNG Limited (US$7.0 billion).

This raises two questions. First, will US$10.0 billion be enough? Second, can the authorities really raise US$10.0 billion?

We have never seen an assessment of the foreign exchange backlog. Foreign airlines, shipping companies and portfolio investors are sitting on large sums of Naira waiting to be converted into US dollars and sent home.

Then there are the matured foreign exchange obligations of the CBN to Nigerian banks which are widely reported as close to US$7.0 billion. Whether the total, once netted off, is actually US$10.0 billion is a moot point.

Second, the authorities have indeed started raising the money with forward sales (and are beginning to settle their obligations with banks). Project Gazelle was reported in the press as designed to secure US$3.3 billion from a consortium of international lenders over five years with an interest rate of 11.85% (we cannot independently verify these details).

This kind of deal gets the ball rolling though we note that the Project Gazelle appears to be one of a series of similar deals made on behalf of the NNPC over several years, starting in 2020, with perhaps US$3.3 billion already raised. This raises the question over how much more capacity there is, in the terms of the NNPC’s future oil production and royalties, to borrow against.

The NNPC cannot mortgage all its production for obvious reasons: it needs to remit regular payments to the Federal Government (for its budget) and, as one would expect from standard lending practice, pledges more future production than necessary for the purposes of loan security.

This leaves the larger sum to be raised from the government’s stake in Nigeria LNG Limited. Details are not available at this time.

Does this sound pessimistic? We think not. Banks do not publicise their loan agreements (not until they are completed) so it is quite likely that more is happening than meets the eye.

And note that when these details are announced (see the dip in the parallel market rate back in early November) the parallel market reacts positively.

It is just that the market is dealing with a lot of unknowns at the moment. Consequently, it is taking a dim view of things.

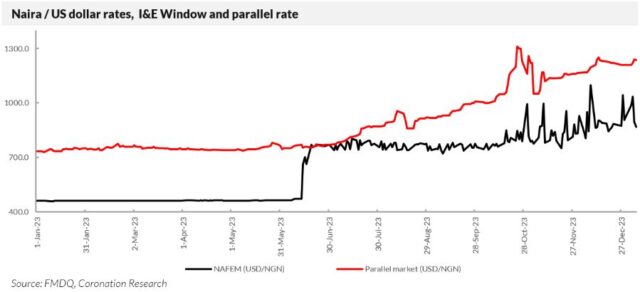

Readers might think that, under these circumstances, we cannot make forecasts. But we can make some. To begin with, the chart on this page shows the NAFEM rate and the parallel rate diverging in 2023: we do not think they will hold their current positions during 2024. Active financial markets almost never trade like that.

They will either converge (because the Nigerian authorities find enough money to settle the backlog of foreign exchange demand, and confidence picks up); or they will diverge again.

A third possibility is that the authorities capitulate and leave the NAFEM rate to merge with the parallel rate, although this would go against the CBN’s signals that it wishes to exercise control over the FX market.

If we have a bias as a research department, it is towards optimism. We think that a meaningful part of the backlog will be settled and that participants will appreciate that the parallel market rate is extremely cheap. We shall see.-With Coronation Research analysis.

X-@theGBJournal|Facebook-the Government and Business Journal|email:gbj@govbusinessjournal.com|govandbusinessj@gmail.com