TUE, SEPT 12 2023-theGBJournal |It may be a fanciful thought, ”but the sophisticated trades between Airtel Africa’s NGX Exchange listing and its London listing point to convergence, at least in the short term, between the arbitrage price and the parallel exchange rate,” says Coronation Research in its Nigeria Weekly update.

Nigeria is several months into its currency reform and the picture, so far, is frustrating. The I&E Window rate is N736.6/US$1 and the parallel exchange is close to N930.0/US$1, the gap having widened to 26.3% over the past few weeks.

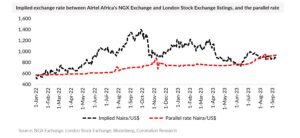

Yet one small part of the foreign exchange market appears to be reaching a consensus, at least in the short term, with the implied exchange rate between Airtel Africa’s shares traded in Nigeria and those traded in London reaching

N876.8/US$1, very close to the parallel market rate.

This was not always so. For much of 2022 and early 2023 the two exchange rates were out of kilter – by a wide margin.

In late September 2022, the implied exchange rate was nearly N1,400/US$1, while as recently as last March it reached N1,210/US$1. This meant that some traders were prepared to buy Airtel Africa shares on the NGX Exchange at N1,548.7/s, have them cancelled and reissued in London, and sell them GBP1.05/s, paying N1,480.6 per Pound Sterling or N1,210.3 per US dollar.

It was an expensive way of purchasing US dollars when the parallel exchange rate was N746.0/US$1, though it had the advantage of delivering funds to the recipient via the London Stock Exchange.

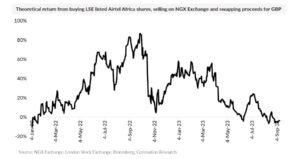

Of course, with such a huge differences between the arbitrage rate (N1,210/US$1) and parallel rate (N746.0/US$1) it also made sense to do the trade in reverse.

Arbitrageurs would buy London-listed shares, have them cancelled in London and reissued in Lagos, then sell the NGX Exchange listed shares for Naira and trade the proceeds via the parallel market for pounds or US dollars. With the share prices so far apart such trades could realise a return in excess of 40.0%.

Clearly, more participants are aware of this trade, and more participants have made themselves capable of doing it, than before. The arbitrage opportunity has all but disappeared.

This implies that a large number of professional investors are involved and it is interesting that the implied rate is close to the parallel exchange rate.

It is a feature of exchange rates settling down, in our view, that different arbitrage and parallel rates eventually converge.

This is not to say that either the parallel exchange or the exchange rate implied by Airtel Africa’s two listings have any bearing on where the Naira/US dollar rate will settle. Nor do they have any bearing on the Naira/US dollar rate in the I&E

Window; nor do they have any bearing on the fair value of Naira/US dollar.

But it may be a sign that the currency markets are becoming a little more efficient than they were.Analysis is provided by Coronation Research.

Twitter-@theGBJournal|Facebook-the Government and Business Journal|email:gbj@govbusinessjournal.com| govandbusinessj@gmail.com