…Treasury bonds secondary market were bearish

…NTB secondary market were bullish

WED, AUGUST 30 2023-theGBJournal |The Nigerian equities market recorded its first loss of the week, as sell pressures on TRANSCORP (-10.0%) and ZENITHBANK (-1.8%) caused a 0.1% decline in the benchmark index.

Thus, the All-Share Index settled at 66,439.53 points. Consequently, the Month-to-Date and Year-to-Date gains declined to +3.3% and 29.6%, respectively.

The total volume traded increased by 45.8% to 637.19 million units, valued at NGN7.79 billion, and exchanged in 10,033 deals. TRANSCORP was the most traded stock by volume and value at 292.41 million units and NGN2.15 billion, respectively.

On sectors, the Insurance (+1.5%), Consumer Goods (+0.3%) and Industrial Goods (+0.1%) indices advanced, while the Banking (-0.3%) index declined. Meanwhile, the Oil & Gas index closed flat.

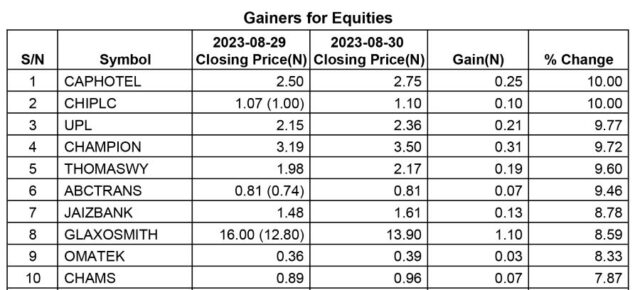

As measured by market breadth, market sentiment was positive (1.1x), as 27 tickers gained relative to 24 losers. CHIPLC (+10.0%) and CAPHOTEL (+10.0%) recorded the highest gains of the day, while TRANSCORP (-10.0%) and CWG (-9.9%) topped the losers’ list.

The naira appreciated by 5.0% to NGN738.18/USD at the I&E window.

The overnight lending rate contracted by 10bps to 3.0%, in the absence of any significant inflows into the system.

Activities in the NTB secondary market were bullish as the average yield dipped by 2bps to 7.3%. Across the curve, the average yield declined at the short (-9bps) end due to demand for the 71DTM (-45bps) bill, but remained flat at the mid and long segments. Similarly, the OMO segment traded on a bullish note as the average yield contracted by 11bps to 11.0%.

Proceedings in the Treasury bonds secondary market were bearish as the average yield advanced by 6bps to 14.1%. Across the benchmark curve, the average yield expanded at the short (+24bps) end following the sell off of the MAR-2025 (+113bps) bond.

Elsewhere, the average yield closed flat at the mid and long segments.

Twitter-@theGBJournal|Facebook-the Government and Business Journal|email:gbj@govbusinessjournal.com| govandbusinessj@gmail.com