SAT, JUNE 17 2023-theGBJournal |Activities in the Treasury bills secondary market were bearish this week, as the lower liquidity system influenced the reduced demand for bills across the spectrum.

At the same time, bearish sentiments returned to the Treasury bonds secondary market as investors booked profits at the short and long ends of the naira curve. Consequently.

Treasury bills average yield expanded by 2bps to 6.3%. At this week’s NTB PMA, the Central Bank of Nigeria (CBN) offered N34.54 billion – N1.01 billion of the 91-day, N1.29 billion of the 182-day, and N32.15 billion of the 364-day – in bills to participants.

The total subscription level settled at N286.13 billion (vs N830.19 billion at the previous auction), with more demand skewed toward the longer-dated bills (N277.27 billion translating to 96.9% of the total subscription).

As in the previous auction, the CBN allotted precisely what was offered at respective stop rates of 4.89% (previously: 4.48%), 5.12% (previously: 6.00%), and 8.24% (previously: 9.45%).

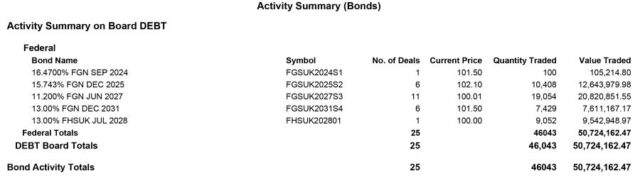

Meanwhile, treasury bonds average yield increased by 2bps w/w to 13.8%.

Across the benchmark curve, the average yield expanded at the short (+4bps) and long (+4bps) ends, following sell-off on the MAR-2027 (+20bps) and APR-2049 (+24bps) bonds, respectively.

Meanwhile, the average yield contracted at the mid (-2bps) segment as investors demanded the APR-2032 (-3bps) bond.

Twitter-@theGBJournal|Facebook-the Government and Business Journal|email:gbj@govbusinessjournal.com| govandbusinessj@gmail.com