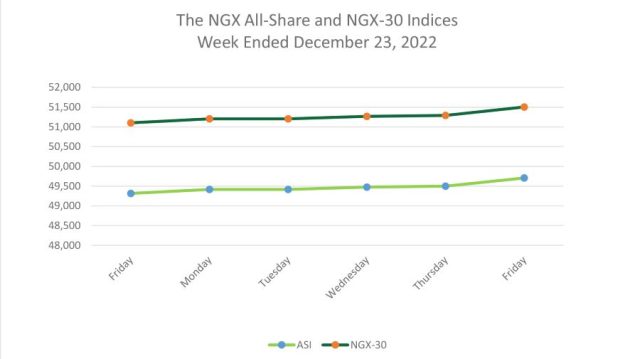

SAT. 24 DEC, 2022-theGBJournal| This week, the dominance of the bulls ensured the local bourse closed the week in the green territory, as the benchmark index recorded gains in all trading sessions, save for the second trading session when the market closed flat.

The All-Share Index advanced by 0.8% w/w to close at 49,706.09 points, as bargain hunting in GTCO (+7.4%), STANBIC (+8.6%), FBNH (+8.3%), BUAFOODS (+2.5%), and GEREGU (+9.0%) spurred the positive outturn.

Based on the preceding, the MTD and YTD gains rose to +4.3% and +16.4%, respectively.

Activity levels mirrored the market’s broad gauge as trading volume and value increased by 9.4% and 40.0% w/w, respectively.

Sectoral performance was broadly positive following gains in the Banking (+1.5%), Consumer Goods (+1.0%), Oil and Gas (+0.9%), and Insurance (+0.3%) indices. On the other hand, the Industrial Goods index closed flat.

Overall, 860.933 million shares worth N16.134 billion in 14,502 deals was traded this week by investors on the floor of the Exchange, in contrast to a total of 814.089 million shares valued at N12.204 billion that exchanged hands last week in 15,488 deals.

NGX data shaows that trading in the top three equities namely UPDC Real Estate Investment Trust, FBN Holdings Plc and Guaranty Trust Holding Company Plc (measured by volume) accounted for 440.239 million shares worth N3.015 billion in 2,038 deals, contributing 51.13% and 18.69% to the total equity turnover volume and value respectively.

Meanwhile, Global stocks posted mixed performances this week as sentiments were shaped by positive economic data in the US and Europe and recession worries following a fresh round of hawkish comments from major central banks.

The US equities (DJIA: +0.3%; S&P 500: -0.8%) swayed between gains and losses as investors weighed the course of monetary policy from the US Fed against positive growth data.

On the other hand, European stocks (STOXX Europe: +1.9% and FTSE 100: +0.6%) were on course to close the week in green as investors digested a slew of earnings announcements and economic data from the region.

In the same vein, Asian markets posted negative performances with the Japanese (Nikkei 225: -4.7%), and Chinese (SSE: -3.9%) equities suffering huge losses as investors assessed a hawkish policy pivot by the Bank of Japan (BOJ), Japan’s inflation data and a spike in Covid-19 cases in China.

Elsewhere, the Emerging market (MSCI EM: +0.7%) closed positively, primarily driven by gains in Brazil (+4.6%), which offset losses in China (-3.9%).

On the other hand, the Frontier market (MSCI FM: -1.6%) index declined due to selloffs in the Vietnamese (-3.1%) market.

Twitter-@theGBJournal|Facebook-The Government and Business Journal|email:gbj@govbusinessjournal.ng|govandbusinessj@gmail.com