TUE, 01 NOV, 2022-theGBJournal| Last week, trading in the Federal Government of Nigeria (FGN) bond secondary market was bearish amidst tight system liquidity. As a result, the average benchmark yield for bonds rose 16bps to close at 14.31%.

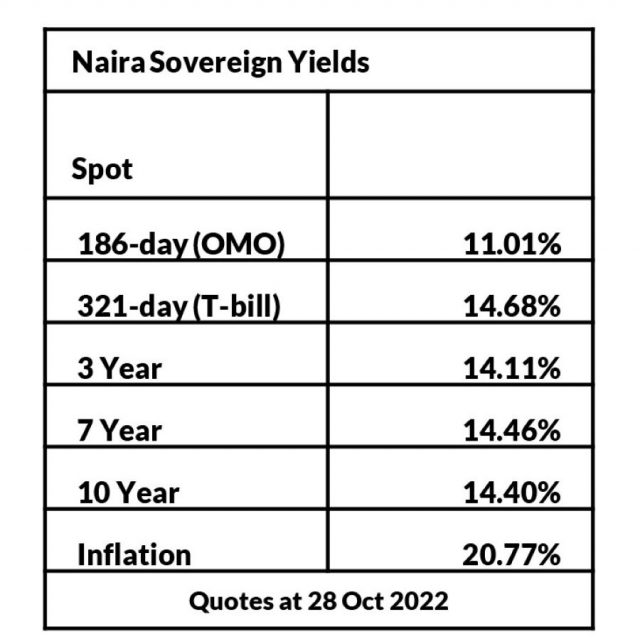

Across the curve, the yields on the 7-year (+20bps to 14.46%) and 10-year (+9bps to 14.40%) bonds expanded, while the yield on the 3-year bond remained unchanged at 14.11%. Coronation Research analysts in a note to theG&BJournal say their view remains that the combination of thin system liquidity and elevated Federal Government domestic borrowing will continue to drive yields upwards over the coming months.

Activity in the Treasury Bill (T-Bill) secondary market was also bearish as selloffs persisted, especially at the short segment of the curve, also in the face of tight system liquidity. As a result, the average yield for T-bills rose by 76bps to 11.04%. Conversely, the yield on the 321-day T-bill compressed by 74bps to close at 14.68%. At the T-bill primary auction, the DMO allotted N109.18bn (US$245.50m) worth of bills.

The auction recorded a total subscription of N136.96bn, implying a bid-to-cover ratio of 1.25x (vs 1.69x average of the past auctions in the year). Consequently, stop rates across the 91-day (+3bp to 6.50%), 182-day (+15bps to 8.05%) and 364-day (+150bps to 14.50%, implying an 16.95% yield) bills rose. Elsewhere, the average yield for secondary market OMO bills fell by 2bps to 10.23%, while the yield on the 186-day OMO bill fell by 2bps to 11.01%.

Twitter-@theGBJournal| Facebook-The Government and Business Journal|email: gbj@govbusinessjournal.ng|govandbusinessj@gmail.com