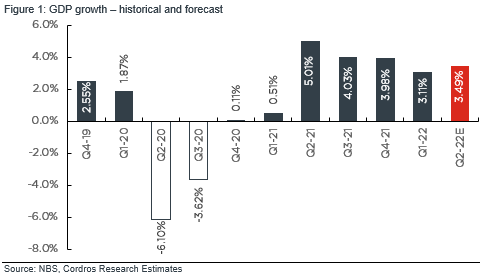

MON, 23 MAY, 2022-theGBJournal | According to the recently released data by the National Bureau of Statistics (NBS), domestic economic activities sustained their positive growth momentum for the sixth consecutive quarter. Specifically, real GDP grew by 3.11% y/y in Q1-22 (Q4-21: 3.98% y/y).

The growth outturn is in line with Bloomberg’s median consensus estimate (3.10% y/y) and 30bps higher than Cordros’ estimate (2.81% y/y), with the deviation stemming from a better-than-expected performance in the Service sector.

Parsing through the breakdown provided, we highlight that the growth was primarily driven by the ICT (12.07% y/y vs Q4-21: 5.03% y/y), Trade (6.54% y/y vs Q4-21: 5.34% y/y), Finance & Insurance (23.24% y/y vs Q4-21: 24.14% y/y), Agriculture (3.16% y/y vs Q4-21: 3.58% y/y), and Manufacturing (5.89% y/y vs Q4-21: 2.28% y/y) sectors. Overall, the Oil sector contributed 6.63% to the GDP while the Non-oil sector contributed 93.37%.

No Respite for the Oil Sector

The Oil sector maintained its negative growth rate for the eighth consecutive quarter, declining by 26.04% y/y (Q4-21: -8.06% y/y) – the worst performance on record since the NBS started keeping current data series.

The last time the Oil sector declined close to this level was in Q3-16 (-23.04% y/y) – a period characterised by unabating vandalism of oil assets and rampant crude oil theft in the Niger Delta region. Notably, crude oil production (including condensates) declined to a new record low, averaging 1.49mb/d in Q1-22 (Q4-21: 1.50mb/d).

We believe the continuous low crude oil production reflects the impact of (1) infrastructure decay, (2) massive thefts and vandalism, and (3) divestments, given the challenging business environment amidst companies’ move to cleaner energy sources. To underscore the scale of things, data from the Nigerian Upstream Petroleum Regulatory Commission (NUPRC) showed that crude oil production declined across the Bonny (-49.0% y/y), Escravos (-18.9% y/y), Agbami (-13.8% y/y), Bonga (-7.3% y/y), and Forcados (-3.5% y/y) production terminals; the aforementioned terminals jointly contributed 44.0% to total crude oil production in Q1-22.

Non-Oil Sector Remains the Engine of Growth

The Non-oil sector grew by 6.08% y/y (Q4-21: 4.73% y/y) – the highest in four quarters. Our attribution analysis showed that the ICT and Trade sub-sectors were the key drivers behind the sector’s growth. Other sub-sectors that contributed to the Non-oil sector include the Finance & Insurance, Agriculture and Manufacturing sub-sectors.

Notably, the ICT’s growth is the highest since Q4-20 (14.95% y/y), underpinned by Telecoms given the growth in telecoms subscribers (+3.7% y/y to 199.56 million in Q1-22) amidst the favourable base from the prior year’s corresponding period.

Similarly, growth in the Trade sub-sector continues to reflect the favourable statistical base from the preceding year (Q1-21: -2.43% y/y) amidst the knock-on effects of the effective reopening of the economy in contact-facing sectors. Meanwhile, the Manufacturing (5.89% y/y vs Q4-21: 2.28% y/y) sector recorded its highest growth print since Q4-14 (13.47% y/y) despite the lingering structural challenges facing the sector amidst sustained government intervention.

We Expect the Economy to Grow by 3.49% y/y in Q2-22

We expect the Oil sector to continue to drag overall growth in Q2-22 as actual crude oil production lags the allocation from OPEC+ (Nigeria’s production quota as of the 8th May meeting is 1.77mb/d). Our downbeat outlook is hinged on the nature of the sector’s challenges, the majority of which are unlikely to be resolved in the short term. Accordingly, we forecast crude oil production (including condensates) of 1.55mb/d in Q2-22, translating to the Oil sector’s decline of 8.73% y/y.

Elsewhere, we expect Non-oil GDP growth to moderate to 4.07% y/y in Q2-22, primarily driven by the Service and Agriculture sectors amidst the unfavourable base effects from the prior year. In addition, we expect the Manufacturing sector’s growth to slow, given a plethora of challenges, including rising energy costs, FX challenges, weak consumer spending and rising tax burden on manufacturers. On balance, we expect growth to settle at 3.49% y/y in Q2-22 and revised our 2022FY growth to 3.51% y/y (Previously: 2.92% y/y).-With Cordros Research

Twitter-@theGBJournal|Facebook-The Government and Business Journal|email: gbj@govbusinessjournal.ng|govandbusinessj@gmail.com