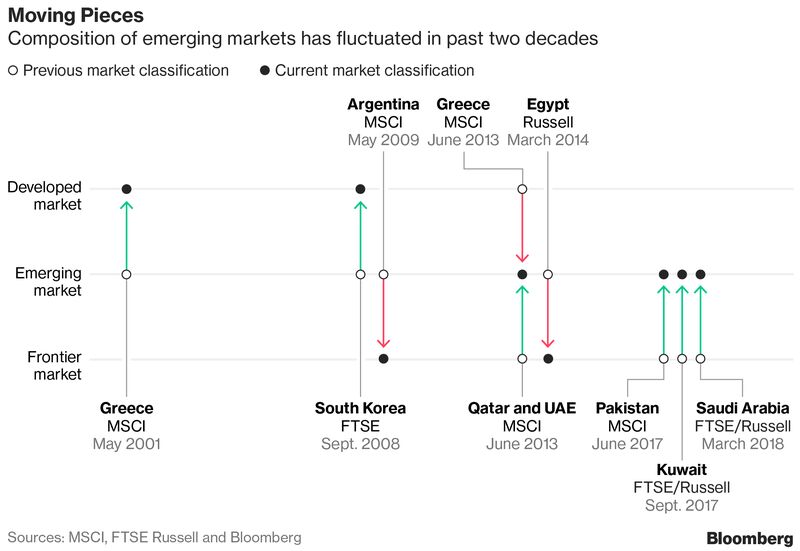

APRIL 18, 2018 – Decades of graduations, demotions, rallies and retreats, have left the world’s $12.5 trillion of emerging-market debt and equities facing a bit of an identity crisis.

So what’s an emerging market?

Emerging markets were defined in the early 1980s as economies with low-to-middle per capita income. Scholars have said the phrase was originally coined by Antoine van Agtmael, then working for the World Bank’s International Financial Corporation. Today, many investors find the term outdated.

Who decides?

While money managers and investment banks have their own definitions, many follow the guidelines of market index makers such as MSCI Inc. and FTSE Russell, both of which declined to comment. The New York-based Emerging Markets Traders Association compiles its own research on the nations.

Why does it matter?

Designation within gauges such as the MSCI EM Index shapes capital flows to nations as passive funds and exchange-traded funds that track them add those securities to their portfolios. Active managers also have benchmarks for performance, which means they too will mimic the benchmark to a degree. For debt traders, the JPMorgan Emerging Market Bond Index and its peers are influential in determining their geographic exposures.

What’s next?

At the moment, the categories of “developed,” “emerging” and “frontier” each have about two dozen nations each, according to MSCI. On May 14, MSCI Inc. will share the results of its review.

FTSE Russell, which rates countries using the same categories, last month reclassified Saudi Arabia as an emerging market. Plenty of nations, including Bosnia Herzegovina, Trinidad and Tobago and Panama, fall outside those primary classifications.

Bearing in mind that nations can slide down as well as up, here are some that could be on the cusp of “graduating” next:

1) South Korea to Developed ($2.6 trillion)

South Korea, home to such global behemoths as Samsung Electronics Co., is an obvious example of a country that could soon be universally known as “developed,” according to Gibbs. While it’s been upgraded by FTSE Russell, MSCI says foreign investors have to go through too many hoops to access the market and can have difficulty converting their profits into other currencies. The nation gets a boost as one of two Asian OECD members.

2) Taiwan to Developed ($998 billion)

The developed title has proven elusive for Taiwan due to inconvenient trading systems and a currency that’s not freely convertible. But it’s not far off. The island is among the 10 safest countries for sovereign debt investors, according to a BlackRock risk index, ahead of developed nations such as Canada, Australia and Germany. China, which still claims it as a territory, is also classified as an emerging market.

3) Poland to Developed ($375 billion)

Despite disputes with the European Union over domestic judicial reforms, Poland meets 22 of 23 criteria by FTSE to be called a developed market. Companies from clothing retailer LPP SA to shoemaker CCC SA are also expanding their footprints in Western markets.

4) Argentina to Emerging ($279 billion)

Under President Mauricio Macri, Argentina has returned to the foreign bond market, opened foreign-exchange markets and stripped taxes on equity transactions. Those are all reasons why Bulltick’s Kathryn Rooney Vera expects the South American nation to reclaim its emerging-market status this year. Manraj Sekhon, chief investment officer of emerging-markets equities at Franklin Templeton Investments, also expects an Argentina upgrade amid improved economic governance under the Macri administration.

5) Chile to Developed ($254 billion)

Returning to the presidency of Latin America’s wealthiest country, billionaire Sebastian Pinera pledged to “transform Chile into a developed nation” by reducing poverty and increasing foreign investment.

6) United Arab Emirates to Developed ($164 billion)

The UAE, which only five years ago climbed to emerging-market status, has done well in terms of both economic and market development, Gibbs said. Its participation in the OECD Development Assistance Committee also bodes well. Similarly to China, transparency and governance remain hurdles.

7) Nigeria to Emerging ($110 billion)

One of Africa’s largest economies, Nigeria benefits from strong demographics, attractive local businesses and political stability, according to Claudia Castro, the director of fixed-income research at Oppenheimerfunds Inc. in New York.

8) Zimbabwe to Frontier ($2.2 billion)

There’s a reasonable chance Zimbabwe’s economy will get a significant capital injection in the next year, according to Hasnain Malik, head of equities research at Exotix Capital in Dubai. The nation’s new president, Emmerson Mnangagwa, told Bloomberg in January that he plans on tapping debt markets to help rebuild infrastructure. That could give a boost to the unclassified African nation.