TUE, MAY 31 2023-theGBJournal |Shares of MCNICHOLS (10% change) led 30 other climbers on the gainers list Wednesday as the NGX Exchange closed the month’s trading session on a bullish note.

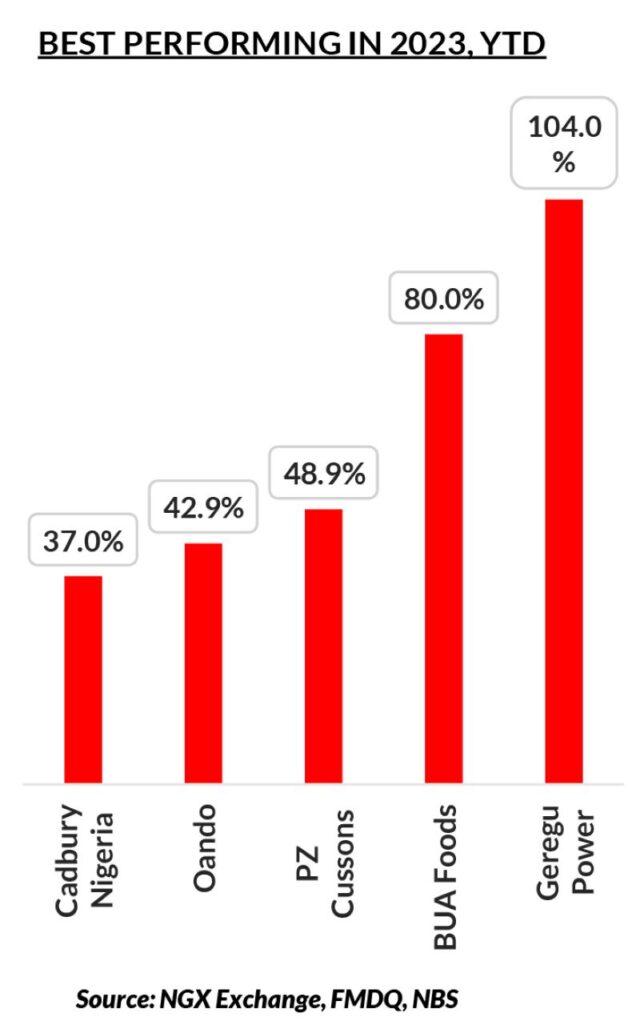

Sustained demand for MTNN (+0.40%), BUAFOODS (+5.61%) and GEREGU (+1.68%) offset losses in Tier-1 banking names ZENITHBANK (-2.36%), GTCO (-2.38%) and ACCESSCORP (-0.40%) to keep the broader index in the positive terrain.

The NGX All-Share Index ended the day with a 4bps gain to settle at 55,769.28 points.

Market activities showed trade turnover settled higher relative to the previous session, with the value of transactions up by 20.25%.

A total of 661.51m shares valued at N19.00bn were exchanged in 10,024 deals. ACCESSCORP (-0.40%) led the volume chart with 98.73m units while GEREGU (+1.68%) led the value chart in deals worth N9.76bn.

Market breadth closed negative at a 1.43-to-1 ratio with declining issues outnumbering advancing ones.

Bullish sentiments persisted in the Treasury bills secondary market, as the average yield contracted by 42bps to 6.2%. Across the curve, the average yield declined at the short (-228bps), mid (-9bps), and long (-39bps) segments, due to buying interests on the 8DTM (-228bps), 99DTM (-109bps), and 253DTM (-143bps) bills, respectively.

Meanwhile, proceedings in the Treasury bond secondary market were bearish, as the average yield expanded by 2bps to 13.9%. Across the benchmark curve, the average yield expanded at the short (+12bps) end, following the sell-off of the MAR-2024 (+57bps) bond but contracted at the long (-3bps) end as investors demanded the JAN-2042 (-23bps) bond. Conversely, the average yield was flat at the mid segment.

The overnight lending rate contracted by 100bps to 12.3%, in the absence of any significant funding pressure on the system.

The naira closed flat at NGN464.67/USD at the I&E window.

Twitter-@theGBJournal|Facebook-the Government and Business Journal|email:gbj@govbusinessjournal.com| govandbusinessj@gmail.com