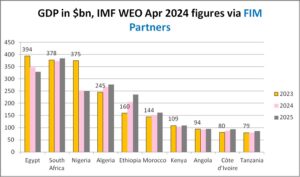

…Egypt and Nigeria have delivered currency reforms that make their currencies about the cheapest in the world on my REER model, 30% undervalued to their long-term history.

….South Africa is on the verge of choosing its first multi-racial government in 30 years – a government which is likely to push ahead with pro-growth reforms.

…Angola is continuing hard subsidy reforms as it tries to diversify its economy.

By Charlie Robertson

FRI JUNE 14 2024-theGBJournal| After more than a decade of deteriorating markets since the Africa Rising – we’ve now seen a stream, or actually, a fast-flowing river, of positive developments across the continent in 2024.

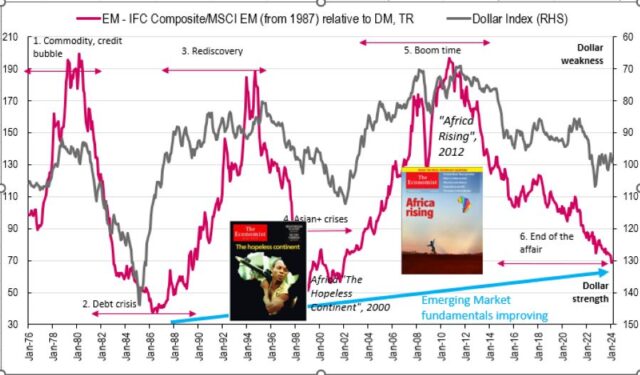

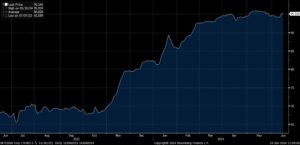

A chart of EM equities vs DM equities (the red line below) shows we’re nearly back to the lows of The Hopeless Continent in the year 2000 – which suggests many markets have priced in all the bad news, but not much of this flow of good news.

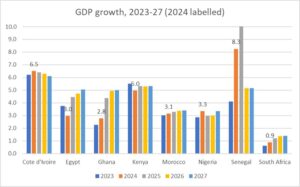

South Africa is on the verge of choosing its first multi-racial government in 30 years – a government which is likely to push ahead with pro-growth reforms. While I feared the ANC would not make this choice, I’d see a decent case for South Africa’s GDP to start rising at 3% a year instead of the 1% the IMF has been expecting.

Egypt and Nigeria have delivered currency reforms that make their currencies about the cheapest in the world on my REER model, 30% undervalued to their long-term history.

SA, Egypt and Nigeria are basically the biggest economies in Africa – so when it’s all going wrong, it sends a very negative signal. The change in outlook a big deal.

Kenya is slashing its budget deficit from nearly 6% of GDP to 3% of GDP in the budget put to parliament yesterday. Its currency is one of the strongest performers vs the US$ in the world this year.

Senegal saw contested elections which the opposition won. They then rowed back from pre-election populism. Senegal will be one of the fastest growing economies in the world in 2024-25 with around 8-10% growth.

Angola is continuing hard subsidy reforms as it tries to diversify its economy.

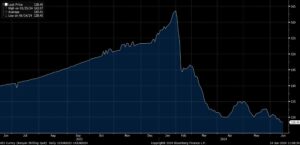

Countries like Tunisia have avoided default (see 2025 Eurobond price below), and even Zimbabwe has introduced (another) currency to get inflation down.

Zambia has found agreement on its debt restructuring. Ethiopia and Ghana should follow later in the year.

Ethiopia is about to IPO 10% of its telecom company in what will be de facto launch of popular capitalism in the country. I expect an IMF backed reform package to come within months involving currency, interest rate and fiscal reforms.

And how have markets reacted?

Ironically it is this month which Blackrock has decided to shut down its Frontier ETF – after struggling with all the FX issues that beset markets like Nigeria and Egypt in recent years.

Debt markets (Kenya, Egypt, Nigeria shown below) though have loved the story. And while still providing a high return in US dollars, now give us a high return in local currency trades too, most obviously in Egypt.

I’ve not seen such a stream of positive developments on the continent in at least a decade. Of course this has come just two years after I’ve published The Time Travelling Economist, which explains the underlying structural challenges that have contributed to the past decade of poor performance

And this doesn’t mean that people on the ground are better off today. In fact, it’s the reverse – with devaluation and tax rises undoubtedly making many feel this is the worst year they’ve experienced in a long time.

But we now have reasons to believe that economies can recover, via export growth, improved current accounts, lower interest rates in coming years, and via economic reforms which help businesses and households work effectively.

A truly remarkable year.

Charlie Robertson, Head of Macro Strategy, FIM Partners UK Ltd

X-@theGBJournal|Facebook-the Government and Business Journal|email:gbj@govbusinessjournal.com|govandbusinessj@gmail.com